Polarisation

Laurent Denize, Global Co-CIO, ODDO BHF AM.

” Despite the uncertain macroeconomic cycle, such periods bring numerous opportunities for investors who can see beyond the current noise and focus on the long term.”

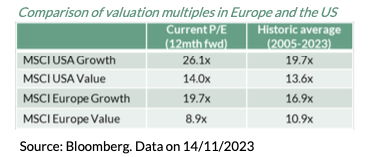

The spectacular rise in interest rates over the last two years has not been without collateral damage. Against this backdrop, equity markets remain polarised. The most glaring example is undoubtedly in the United States, where the rise in the market (+15% for the S&P 500 year to date) can almost be entirely attributed to the performance of the “Magnificent Seven”, considered as high-growth stocks (rightly so). The MSCI USA Growth index is up 36% since the start of the year, while the MSCI USA Value index, penalised by the risk of a recession, is down 2%. This polarisation is also visible in Europe, where 45% of the growth in the Stoxx Europe 50 index since the beginning of the year can be attributed to the performance of two stocks: Novo Nordisk and ASML. In terms of valuations, it is worth noting that the outperformance of US markets in 2023 has accentuated Europe’s discount, which has now reached a record 35%.

The valuation of cyclical companies in Europe now factors in a severe recession scenario

Never before has a recession been so widely predicted. Although the European economy has shown great resilience, the slowdown has already been felt for several quarters by the most cyclical stocks. Chemicals, steel, pulp and paper, as well as mining companies, which are among the sectors most sensitive to economic cycles, have seen their business and profitability plummet in recent quarters, owing to customer destocking. Unsurprisingly, these sectors have seen the sharpest declines in quarterly earnings.

Nevertheless, we remain convinced that the bulk of this destocking phase, which weighed on volumes, is now behind us. Recent quarterly publications have shown that a large number of these companies are seeing their volumes stabilise. What is more, many cyclical companies are now trading at valuation levels that already price in a severe recession scenario, similar to that seen in recent economic contractions.

While these companies were the first to be hit by the economic slowdown, it should be reminded that they will also be the first to benefit from a rebound in business indicators, according to our analyses.

Investing in cyclical companies at this stage of the cycle does, however, require special attention to be paid to the quality of their balance sheets to ensure that they will be able to withstand any slowdown in the economy.

We remain cautious on equities, with a preference for high quality European companies

In this context, we are slightly increasing our exposure to European equities, both in some discounted stocks and in growth stocks. Stabilising interest rates will benefit the latter, even if most of the rerating (expansion of P/E ratios) has already taken place. The earnings trajectory will therefore be the key parameter for outperformance or underperformance in the coming months.

Despite the uncertain macroeconomic cycle, such periods bring numerous opportunities for investors who can see beyond the current noise and focus on the long term. It’s time to move away from the dichotomy of growth stocks versus value stocks. Quality companies can be found on both sides of the spectrum, as evidenced this year by similar relative performances in Europe.

Against this background, we remain convinced that stock picking will be a key differentiating factor for performance in 2024, as it was this year.