The benefits of gold in the investment portfolio

Prof. Dr. Jan Viebig Global Co directeur des investissements, ODDO BHF AM.

“We are convinced that gold has a firm place within a long-term investment strategy. In the short term, however, we remain cautious about its potential.”

Few assets stir as much passionate debate among investors as gold. Particularly in times of economic uncertainty and concerns over the devaluation of paper currencies, the precious metal becomes a highly sought-after safe haven. However, gold as an investment does come with a significant drawback: it doesn’t pay dividends like stocks or interest like bonds. Therefore, investors turn to gold for other reasons: firstly, the expectation of future price appreciation, and secondly, the diversification effect. Gold tends to perform well, especially when investors perceive significant geopolitical risks or threats to the financial and monetary system. Empirical evidence suggests that the price movements of gold have limited correlation with equities. As a result, gold can help mitigate the risks of an equity portfolio. It therefore makes sense to hold a portion of assets in gold as a safeguard against the uncertainties of the world.

We are convinced that gold has a firm place within a long-term investment strategy. In the short term, however, we remain cautious about its potential. At its current valuation of approximately $1,950 per troy ounce, gold appears relatively expensive. The price of gold has already exceeded the $2,000 mark on four occasions in recent years: in August 2020, March 2022, May 2023, and most recently at the end of October, following the Middle East conflict outbreak. Despite persistent concerning developments on that front, gold prices fell back to $2,006 per ounce, after a brief surge late October.

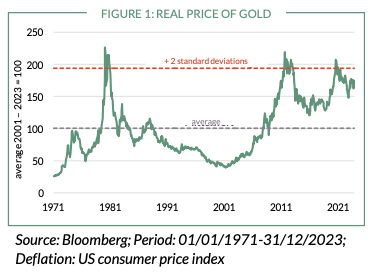

Gold isn’t just expensive in absolute, “nominal” terms. When investing, it is also important to consider whether gold is cheap or expensive in real terms, i.e. adjusted for inflation. According to research by economists Claude Erb and Campbell Harvey, the success of an investment in gold is influenced by the real price of gold. Figure 1 illustrates the historical trend of the price of gold in dollars relative to changes in American consumer prices. We use the CPI index to adjust the price of gold for inflation. The chart reveals that, even after adjusting for inflation, gold holds a significantly high valuation: the real price of gold sits just below the threshold of two standard deviations above its long-term average (see Fig. 1).

Over 50 years, the real price of gold has been higher than its recent level in fewer than 10 percent of the months.”

Holding gold comes at a price, which economists refer to as opportunity costs. The portion of assets invested in gold is not available for investments that earn dividends or interest. Gold buyers therefore forego interest income. The greater this sacrifice, the more painful it is for the investor. As long as capital market interest rates were close to zero, the interest disadvantage was negligible. Today, however, investors can secure a 2.7 per cent yield even with a relatively low-yielding ten-year German government bond. A ten-year US government bond is currently yielding around 4.5 per cent. And good quality corporate bonds offer even higher yields than their government counterparts. The recent changes in the interest rate environment is likely an important reason why investors have increasingly withdrawn from gold investments over the last two years. For instance, the gold holdings of ETFs have fallen by around 23 million troy ounces compared to the 2020 peak, which is more than a 20 per cent drop (see Fig. 2).

We assume that the era of low, zero and negative interest rates is a thing of the past. The interest rate disadvantage is likely to remain a hurdle for gold. However, we aren’t inclined to entirely forgo this precious metal. The current geopolitical risks are too unpredictable for such a move. There are conflicts going on in many places that could easily develop into major crises. We are also concerned about soaring national debts in most countries. In the US, national debt stands at around 120 percent of GDP, while in Italy, it is 143 percent of GDP. With rising yields, the interest burden is surging in both the public and private sectors. Consequently, there remains a justification to invest in gold.