Generative AI may have enthused investors, but it’s only a subplot in the much grander story of the technology sector’s transformation.

Anjali Bastianpillai ,Senior Client Portfolio Manager Pictet Asset Management

Childrens’ homework, social media posts, magazine articles, books – ChatGPT can apparently do it all. The emergence of generative artificial intelligence (AI) has certainly captured the public imagination and revitalised investor enthusiasm for technology stocks. But the truth is that it is only one – admittedly bright – star in the ever-expanding digital universe. By focusing only on generative AI, investors risk missing out on a wealth of other opportunities.

Having managed technology-focused thematic equity portfolios since 1997, Pictet Asset Management has experience in distinguishing hype from genuinely investable new technologies.

One thing investors should know is that AI is not a new technology. Scientists have been working on creating an artificial brain for the past 70 years, starting with a programme that could independently play checkers. The technology has come a long way since then and there is much further to go; ChatGPT is just one stop on the journey.

Unlike many nascent tech innovations, the use cases for generative AI are real and tangible. It can, for example, create characters and storylines in online games, put together financial reports and process increasingly complex customer service questions. However, there are also challenges still to resolve – including the accuracy of its output, the ethics of its use, and, ultimately for us, its commercial viability.

Long-term potential

In our view, generative AI is a significant development that can play a key part in the tech revolution. However, it is worth remembering that the technology is only one subset of deep learning, which in turn is a subset of machine learning, and which itself is only one of the many aspects driving the digitalisation of our world. It’s a complicated landscape. For investors, that means the opportunity is much wider and more tangible than many might believe.

Add in other types of AI – such as natural language processing, machine learning and predictive analysis – and there is great potential within that industry reshape the global economy through meaningful productivity growth. Such technology is already being put to practical use by a variety of industries.

It is being used in online media firms to produce targeted advertising and recommendations, in e-commerce to improve the customer experience, in logistics to streamline supply chain management, and in the travel industry to set hotel prices or schedule events in line with likely demand.

The economic impact of AI’s diffusion could be huge: Goldman Sachs estimates that AI as a whole could add some USD7 trillion to the global economy over the next decade.

Bigger picture

For all its potential, AI is only one aspect of the tech transition.

Although the world appears to have digitalised at a rapid pace, it still has a long way to go.

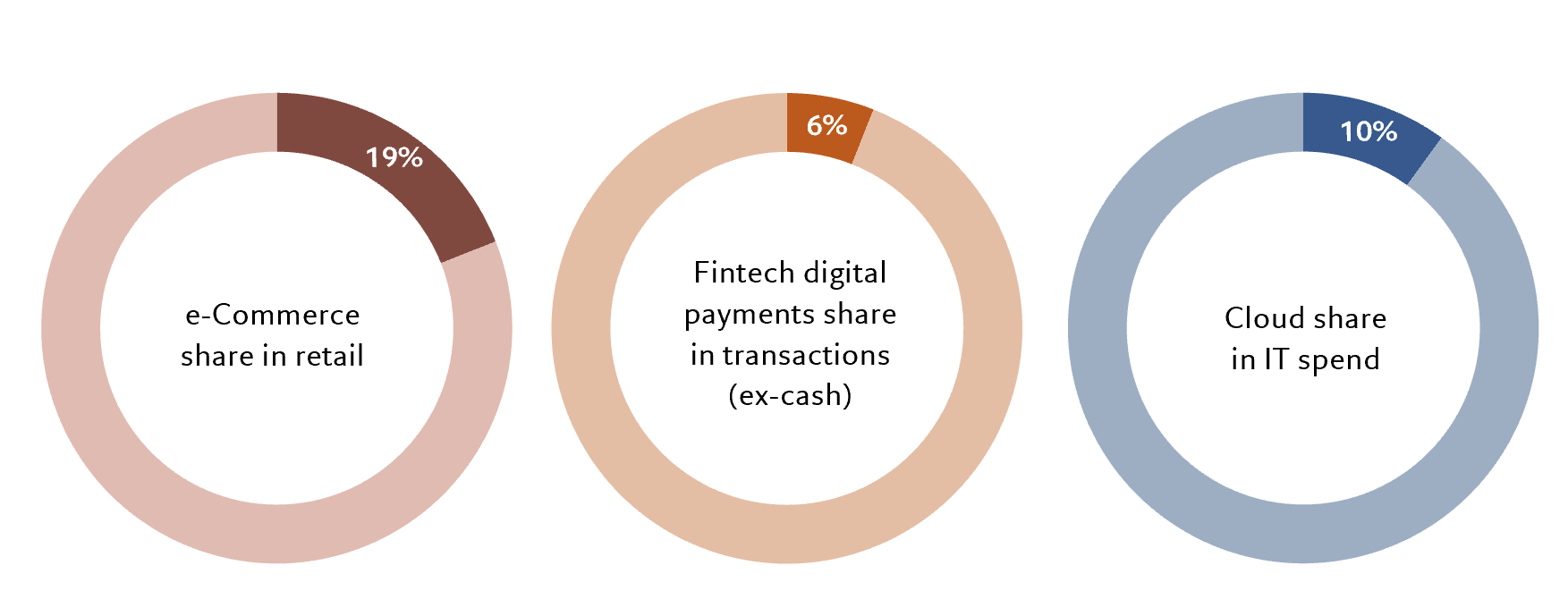

Take e-commerce. It accounts for less than a fifth of the USD26 trillion global retail market. Cloud computing, meanwhile, accounts for just 10 per cent of total IT spend. And only 6 per cent of card transactions are settled through fin tech digital payments (such as those made via your phone).

Each of these areas is forecast to grow at double-digit compound annual growth (CAGR) rate over the next five years. In a low growth world, that amounts to compelling business and investment opportunity.

A more digital world, built on AI and automation, is also likely to be the answer to the increasingly urgent problem of falling productivity.

Our multi asset strategists expect the adoption of automation to become an urgent priority as an ageing population and the shift to flexible working exacerbate existing labour shortages around the world. The realignment of supply chains and pressure to relocate production to more expensive near-/on-shore areas will add further momentum to this trend.

Fig. 1 – Early days for digital

Online penetration for selected industries

Sources: eMarketer, Statista, Gartner, IDC, IMARC Group, PR Newswire, RBR Global Payment Card Data, Pictet Asset Management.

Tactical strength

Admittedly, this year’s rally in tech stocks means valuations are not as attractive as they were only a few months ago. However, we would highlight part of that rally was a reversal of the sector’s underperformance in 2022, before ChatGPT entered the public consciousness.

We also believe that upward corporate earnings revisions in tech will be a more important source of returns than any further expansion in price-to-earnings multiples. The revisions tend to lag price rises (and thus the expansion of valuation multiples) as sell-side analysts are usually slower to recognise a shift in the cycle and update their forecasts. This is especially true in a market upturn. In our Pictet Digital portfolio, returns in the year to date have stemmed mostly from upward revisions to forecasts for earnings per share (EPS) (+28 per cent) rather than multiples expansion (+16 per cent). Notably, we have seen much softer multiple expansion and much stronger EPS revisions than for companies represented in the MSCI IT index, which we believe underscore the value of active management in the digital universe.

We expect companies to continue to beat consensus earnings forecasts, and analysts to continue to raise their projections. There are several reasons for this. The companies in our portfolio benefit from significant operating leverage, or the ability to translate any increases in revenue into meaningful improvements in operating income. As revenue growth stabilises and then re-accelerates, this will prove invaluable. Furthermore, this operating leverage is amplified when companies downsize their operating expenses, which is happening across the board (as has already occurred at Meta, Google, Amazon, Microsoft, Splunk, etc). Already in the second quarter, 90 per cent of tech companies beat earnings expectations, and we think we will see more of this over the coming quarters.

The tech sector also has other advantages in the current environment, such as relatively low leverage. In aggregate, companies in Pictet Digital’s portfolio are positive net cash (compared with 1.6 times net debt to EBITDA for the MSCI ACWI), which is particularly valuable at a time of rising interest rates.

Within the digital universe, we have identified four areas where we believe the prospects are particularly compelling:

- Public cloud platforms: Large public cloud providers (such as AWS (Amazon), Azure (MSFT), Google Cloud Platform (Alphabet) and Oracle) make the adoption of AI possible. Demand for the services offered by cloud platforms, such as computing, storage and networking, is increasing as AI-enabled applications proliferate. Machine learning and AI (including generative AI) continue to scale with large and more complex models that require training on vast amounts of data. Training models of this size and complexity can take a long time and become expensive, so the public clouds are innovating with AI chips and infrastructure options. As such, public cloud companies are among the first to directly monetise this new wave of AI. Public cloud market is forecast to reach USD2.5 trillion by 2032, representing a CAGR of around 20 per cent, according to Gartner.

- E-Commerce: Spending per Internet user has more than doubled since 2015, and is expected to grow further, adding more than USD 1.4 trillion to online spending over the next four years. There is a huge potential to use data to improve the user experience, generate sales and support brand loyalty. In addition, online retailers are further monetising the traffic on their platforms with growing platform adverting business models with high profit margins.

- Application software: As more of our lives become digital, companies are investing more in software and are seeking ever more innovative solutions, with the cloud as one area for investment and growth. Companies which manage to incorporate AI into their software are likely to enjoy a competitive advantage. Software remains a highly profitable, high operating leverage growth market.

- Enabling technologies: For AI and other digital technologies to function we need increasingly advanced semiconductors. The industry is becoming broader; it is still exposed to personal computers but increasingly driven by mobility and AI. Innovation is key to driving improvements in performance and power, all at a lower price. Consolidation and high R&D intensity translate into elevated barriers to entry and therefore pricing power, making it an attractive industry to invest in.

For us, therefore, ChatGPT and the technology behind generative AI is just the latest innovation underpinning the long-term potential of the digital universe. The companies we invest in are innovators with a proven track records to enable, develop and use advanced and evolving technology. As generative AI matures, these companies will be well-placed to harness and monetise its potential – as they will be with the next headline-grabbing innovation.

Being active managers, we are always on the lookout for new ideas and new investment opportunities. But we firmly believe that a broad-based portfolio and a focus on competitive moats is the best route for generating attractive returns over the long term.