Matthew Ryan, CFA – Ebury.

There were no major surprises from the Federal Reserve on Wednesday, with interest rates kept unchanged and Chair Powell striking a hawkish note on the US economy.

Fed fund futures were assigning effectively zero chance of a hike this month, so all attention was on the bank’s communications on the economy, and guidance on interest rates. The bank’s statement was little changed from the previous meeting. As we anticipated, the FOMC repeated the line that additional hikes may be appropriate, while upgrading its assessment of economic activity. According to the Fed, the US economy expanded at a ‘strong’ pace in Q3, an upgrade from the ‘solid’ growth seen in September. Employment gains were said to have moderated, although they remain strong, and the Fed added a note that tighter financial conditions are likely to weigh on economic output.

In his press conference, Chair Powell echoed the statement’s upbeat tone on growth, saying that the US economy had expanded ‘well above expectations’, and that this could put further progress on inflation at risk. He also said that there remained ‘a long way to go’ to achieve the bank’s 2% inflation goal, and that recent encouraging progress on inflation was ‘only the beginning’ of what was needed. Importantly, the Fed is also not yet ready to rule out the possibility of further hikes, and Powell stated that the Fed was ‘not confident [that] policy is sufficiently restrictive’.

These hawkish remarks were interwoven with caution, and Powell appeared keen for markets to not get too carried away with the possibility of additional tightening. In particular, we highlight the added focus in his remarks on the recent tightening in financial conditions, i.e. the sharp increase in Treasury yields that has seen the benchmark 10-year note leap to 16-year highs around 5%. He noted that higher long-term rates, a stronger US dollar and lower stocks would all be taken into account when deciding on future policy, albeit that it was tough to tell how this tightening translates into potential rate hikes.

Figure 1: US Treasury Yields (2022 – 2023)

Following yesterday’s announcement, we stand by our call that the Fed’s tightening cycle is over, and that the next move in rates is more likely to be lower than higher.

This is a view shared by market participants, with futures still seeing less than a 40% implied probability of another 25 basis point hike by the March meeting. As mentioned in our FOMC preview report, the key rationale behind this call is three-fold: US core inflation continues to ease, higher Treasury yields are acting to tighten monetary conditions, and the full impact of previous Fed hikes are yet to be fully reflected in economic data. The latter was mentioned explicitly on more than one occasion during Powell’s press conference.

The Fed has, however, made it clear that it would like to see a period of below-trend growth before it can express confidence on inflation. In particular, we would likely need to see more concrete signs of a cooling in US labour market conditions before rate cuts are even remotely in view. Upcoming nonfarm payrolls reports will be important, in this regard, starting with Friday’s data for October. Any ongoing show of resilience in both job creation and average earnings growth would likely further calm bets in favour of US policy easing, and support our call for no cut in the fed funds rate until at least the second half of 2024.

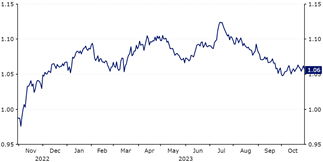

All in all, Powell’s communications were broadly in line with expectations. In short, the US economy is performing extremely well, although additional rate hikes are not guaranteed, in light of the recent tightening in financial conditions, and the time lag of Federal Reserve policy transmission. EUR/USD subsequently ended the press conference little changed.

Figure 2: EUR/USD (November ‘22 – November ‘23)