PMI surveys “Signs that slump in euro manufacturing is bottoming out”

Nadia Gharbi, Senior Economist Pictet Wealth Management.

Signs that slump in euro manufacturing is bottoming out

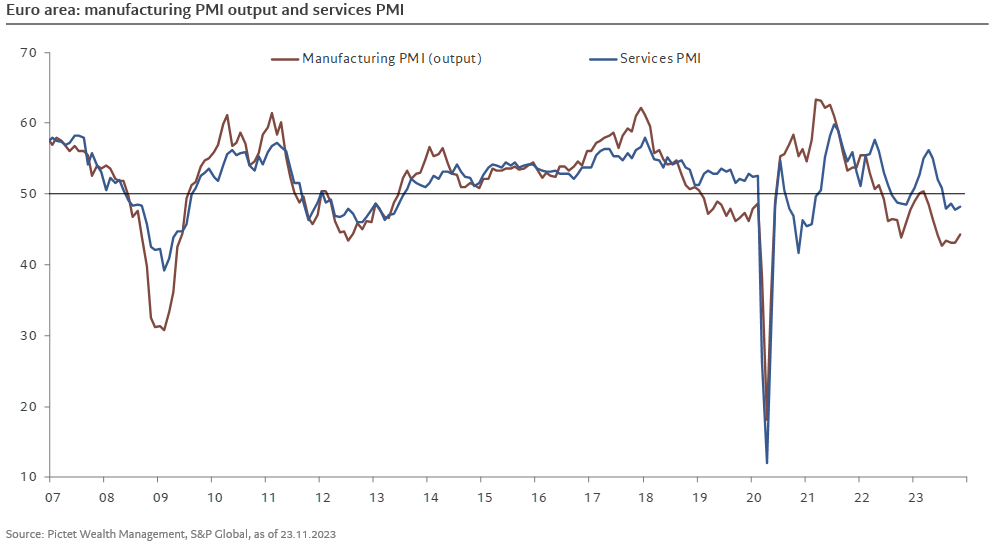

- S&P Global’s flash composite purchasing manager index (PMI) for the euro area rose by 0.6 points to 47.1 in November, above consensus expectations of 46.8.

- The improvement was mostly due to manufacturing, with the output index up 1.1 points to 44.3 in November. The services PMI rose 0.4 points to 48.2.

- There were some encouraging signs in the most forward-looking components of the euro area manufacturing PMI; new orders, exports orders and backlogs of work all improved in November.

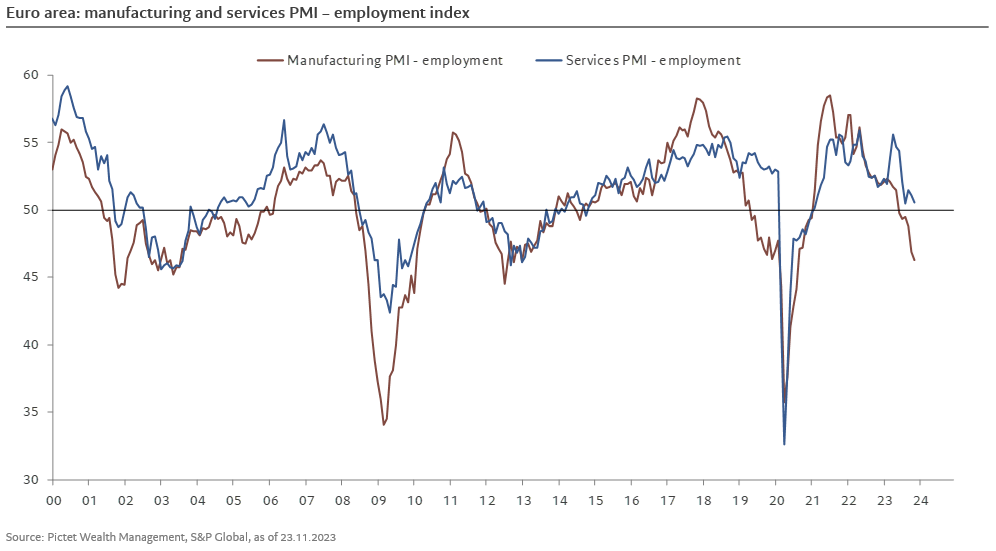

- One downside in November’s report was the further move down in the PMI employment index as small gains in services failed to compensate for losses in manufacturing.

- Companies recorded a further increase in input costs, often as a result of higher wages in services. In addition, selling prices rose too in the services sector. This is consistent with the fact that inflation will take some time to move back to target and will keep the ECB on hold for some time.

- Country wise, the November improvement was skewed towards Germany, where the composite PMI rose 1.2 points to 47.1. Of particular note is the increase in the German manufacturing output PMI for the second consecutive month (+2.7 points to 44.0 in November after a similar gain in October). In France, however, manufacturing output PMI was down by 0.9 points to 41.0.

- Overall, PMIs suggest that the worst of the downturn in business activity is behind us and that manufacturing activity is bottoming out. The average composite PMI for October and November now stands at 46.8, still below the Q3 average of 47.5. Euro area real GDP contracted by 0.1% q-o-q in Q3, and surveys point to the risk that we have another negative print in Q4. However, as we have noted in previous commentaries, PMIs have tended to overestimate economic weakness in the euro area and (hard and other survey) data so far are broadly consistent with our view that GDP will be stagnant in Q4.