Luc Luyet, Currencies strategist, Pictet Wealth Management.

The US Dollar is smilling less

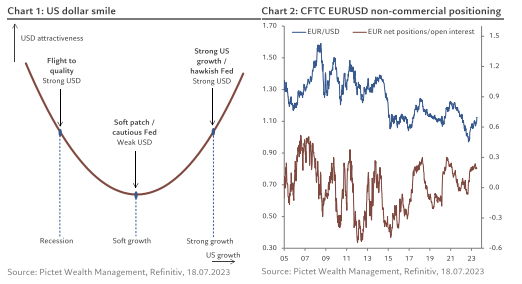

Recent US macroeconomic data strengthens the view that the disinflationary process is well underway, with two key implications for the US dollar. Firstly, it suggests that the end of the Fed’s tightening cycle is getting even closer. Secondly, it increases the likelihood of disinflation happening without the need for a sharp slowdown in the US economy. In other words, weak US economic activity (but not too weak) and a more balanced monetary stance from the Fed are seen as negative for the US dollar (see chart 1). The fresh new lows of the US dollar tend to confirm that markets shared such a view.

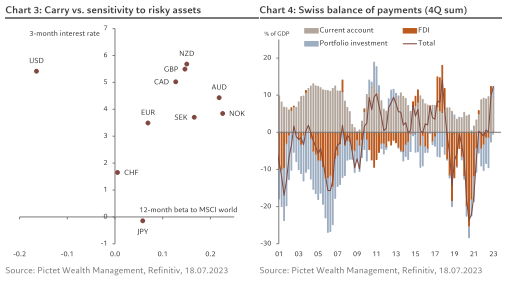

That said, we see reasons for limited downside potential for the US dollar in the short term. Firstly, economic activity in the euro area and China is rather weak. In particular, China’s fiscal measures expected by the end of July may turn out to be more targeted than previously thought, which may lead to a very gradual recovery. The euro and the renminbi may have difficulties outperforming without the support of healthy economic outlooks, which implies limited induced downward pressure on the greenback. Secondly, the EUR/USD rate seems to have overshot what is implied by interest rate differentials. As such, there seems to be some optimistic sentiment built up in the single currency, something confirmed by historically high levels in the net positioning in the futures market (see chart 2). Finally, while US external imbalances favoured a depreciation of the US dollar over time, the current account deficit (-3% of GDP in Q1) is not extreme relative to the long-term average (-2%).

In the longer term, the recent new lows in the US dollar confirm our scenario of a long-term decline of the US dollar. Such a scenario is based on the overvaluation of the US dollar relative to long-term equilibrium estimates and limited support from key medium-term drivers such as interest rate and growth differentials. Convincing signals that the Fed is pivoting to a more accommodative stance will likely be needed to fuel another decline in the greenback.

A DEFENSIVE TILT REMAINS FAVOURED IN THE SHORT TERM

The weak global economic outlook tends to favour a defensive tilt among currencies, especially if such weakness spills over into risky assets. Besides supporting the safe-haven greenback (see chart 3), it could also help the Japanese yen, through reduced usage as a funder in carry-trade strategies. The low-yielding and safe-haven Swiss franc may also benefit from such an environment, especially as flows from the balance of payments look the most supportive in years (see chart 4). Gold may also perform well as investment demand remains highly sensitive to US interest rates. Seasonality and robust official demand could also bring some support to the yellow metal in the second half of the year.

Our relative cautiousness on cyclical currencies is also based on our assumption that most of their central banks are close to the end of their tightening cycles. Without higher yield and with their economies having yet to feel the full impact of the sharp monetary tightening (and those economies are usually highly sensitive to interest rates), we see limited scope for outperformance in the coming months. The weakness of sterling, following the release of June inflation data, tends to confirm that a less aggressive central bank may leave the currency quite vulnerable, even if we acknowledge that the move was likely magnified because of the gap between the policy rate and market expectations of the terminal rate (prior to the release of inflation).

Overall, on the back of the recent decline in the US dollar, which goes in line with our medium-term projections, we have decided to adjust our projections on the EUR/USD rate higher. The three-month projection on EUR/USD is adjusted to USD1.10 (from USD1.08 previously), while the 12-month projection is set to USD1.18 (from USD1.17 previously).