Bruno Cavalier, Chief Economist ODDO BHF.

KEY HIGHLIGHTS:

- United States aside, the economic outlook everywhere else has been revised downward

- The rise in interest rates puts pressure on government budgets

- World trade is fragmented against a backdrop of numerous geopolitical tensions

- A possible re-election of Donald Trump would accentuate protectionism

- On the positive side, disinflation continues, paving the way for monetary easing

According to climatologists, 2023 is set to become the hottest year on record. For economists, however, temperatures have taken a dip. By this, we mean that inflation rates everywhere are much lower than they were at the start of the year, even though the decline is not uniform across all countries. Shortages and supply disruptions due to lockdowns are now a thing of the past. Crucially, the easing of inflationary pressures doesn’t just pertain to a few prices that were artificially inflated by the pandemic or the war in Ukraine.

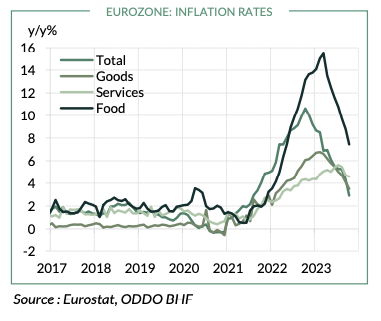

In the eurozone, inflation has recently fallen back below 3%, having peaked at over 10% in 2022. This decline can no longer be attributed solely to the fall in energy prices; it also reflects the easing price tensions affecting food, other goods, and even services (chart). Disinflation will continue into 2024, amidst sluggish economic growth and tighter financing conditions.

Central banks remain cautious about claiming victory. Inflation has not yet normalised. Geopolitical tensions, particularly in the Middle East, have the potential to destabilise energy markets, as history has shown on numerous occasions. That said, the monetary debate has shifted in recent months. At the beginning of 2023, central banks were wondering how quickly and how high to raise key rates. “Faster and higher” was the mantra. Now, the question is how long to maintain a restrictive policy. “Higher for longer” is their new motto. In a few months’ time, we can bet that the question will be about the timing and pace of monetary easing.

In 2023, the US economy has demonstrated amazing strength, defying predictions of a recession or that a recession was the only way to tame inflation. In fact, household spending has accelerated and inflation has slowed. So far, the US is on a soft-landing trajectory. What sets it apart from a recession is a robust labour market. To date, there have been no massive job losses. However, it is worth noting that companies are now more cautious about hiring. The US unemployment rate has been slowly rising for several months. A bifurcation towards a recession in 2024 remains within the realm of possibilities in case unemployment increases massively.

In contrast, the Chinese economy, which should have benefited from the lifting of anti-Covid restrictions, has failed to kick-start a genuine recovery. Confronted with the tightening grip of the state, household and business confidence is lacking.

Monetary and fiscal easing measures have failed to revive the economy, and the country is flirting with deflation. The crisis in the property sector now appears to be a structural impediment in China, revealing the limitations of a growth model that prioritised investment over consumption. The downside of this model is the misallocation of capital, of which the famous ghost towns are the most visible example. It is difficult to imagine China as a major driver of global growth next year.

The European economy is not in great shape either. After a couple of quarters of near stagnation, the eurozone has entered what looks like a mild recession. The energy crisis seems to have been largely overcome, and unlike last year, there are no fears of power cuts this winter. What is lacking now is bank credit, which has dried up in response to the abrupt tightening of monetary policy. This is weighing on investment spending, particularly in the construction sector. After the interest rate shock, debt servicing is more expensive for companies and governments. With financial markets increasingly vigilant about public debt trajectories, governments are compelled to take measures to consolidate their budgets. Consequently, economic risks are tilting to the downside.

Finally, the world is grappling with many political and geopolitical uncertainties. Since the pandemic, trade in goods has become much less fluid, either because of wars or because of new barriers to trade. Protectionism is expressing itself through various forms. There are incentives for energy transition (the IRA programme in the United States), the desire to secure strategic supplies, to boost domestic employment and to counter China’s dominance. The risk of trade fragmentation is real. It would undoubtedly be even greater if Donald Trump were re-elected in November 2024, which is by no means unlikely. During his first term, he called himself the “Tariff Man”, targeting China primarily. If re-elected this time around, he plans to tax all countries exporting to the United States, as a prelude to a global tariff war.