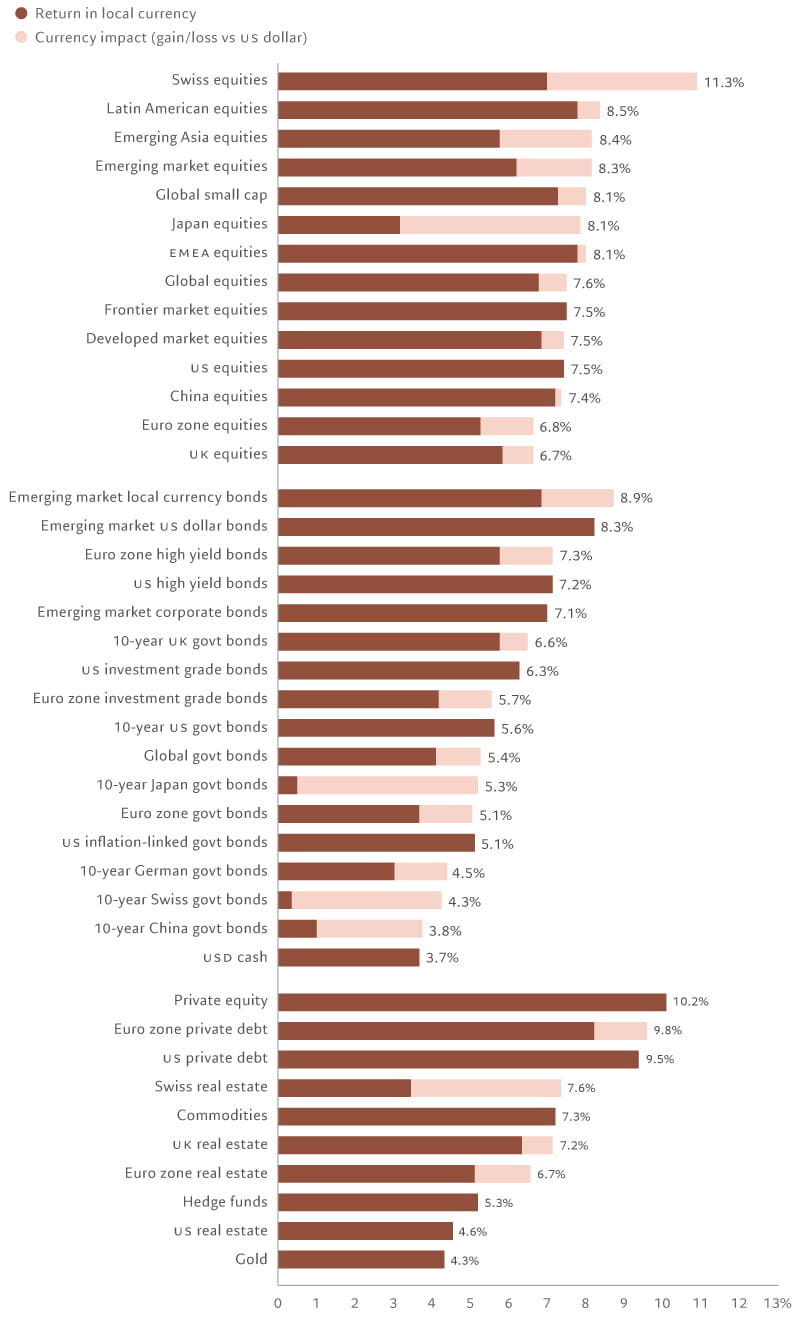

Our analysis shows the dispersion of returns across domestic equity and bond markets will decline over the next five years. This suggests investors should consider investing across sectoral lines and allocate more of their capital to corporate bonds.

Overview : What to expect from markets over the coming five years

The global economy rests on less robust foundations compared to the days when interest rates and inflation were both heading lower and international trade was booming.

Productivity is unlikely to rise much over the remainder of this decade as globalisation stalls and businesses struggle with the growing costs of net zero and labour shortages. As a consequence, we expect only modest GDP growth over the next five years.

Inflation should also prove a stubborn foe; although it will eventually settle within central bank target ranges by the end of this decade, it will be more volatile than policymakers would like.

For active investors, securing superior returns in such an environment means viewing the investment landscape through a different lens.