Bonds are expected to have more volatility than in the past: this will offer careful investors rewarding opportunities.

Mary-Therese Barton, Chief Investment Officer Fixed Income Pictet Asset Management.

It’s a new era for fixed income investing. Investors are only slowly catching on to how significant a shift we’ve undergone from the post-global financial crisis decade of zero interest rates. Which is to say, investors can once again expect to be rewarded for holding bonds and credit instruments. But there’s a catch: unlike the generational bull market that started in the early 1980s, this time the tide won’t be lifting all boats. These waters require deft navigation.

With bond yields higher than they have been for many years, investors no longer need to seek out quality stocks in order to generate return – as they did during the long years of official zero interest rate policy. The bond and credit markets can once again be relied for significant income, which, in turn, gives a buffer against volatility.

But yield isn’t the only source of return from these instruments. There is also scope for considerable capital appreciation as the interest rate cycle starts to turn down – though a likely rise in market volatility will necessitate a careful and active investment approach. As a result, smart investors should be able to generate high single digit returns from fixed income for years to come.

From barbell to belly

During 2023, a barbell approach worked well for investors. That meant, on the one hand, taking substantial positions in money market instruments, making the most of some of the highest low-risk yields available for decades. On the other, investors allocated their risk budgets on illiquid but high-return instruments like private credit.

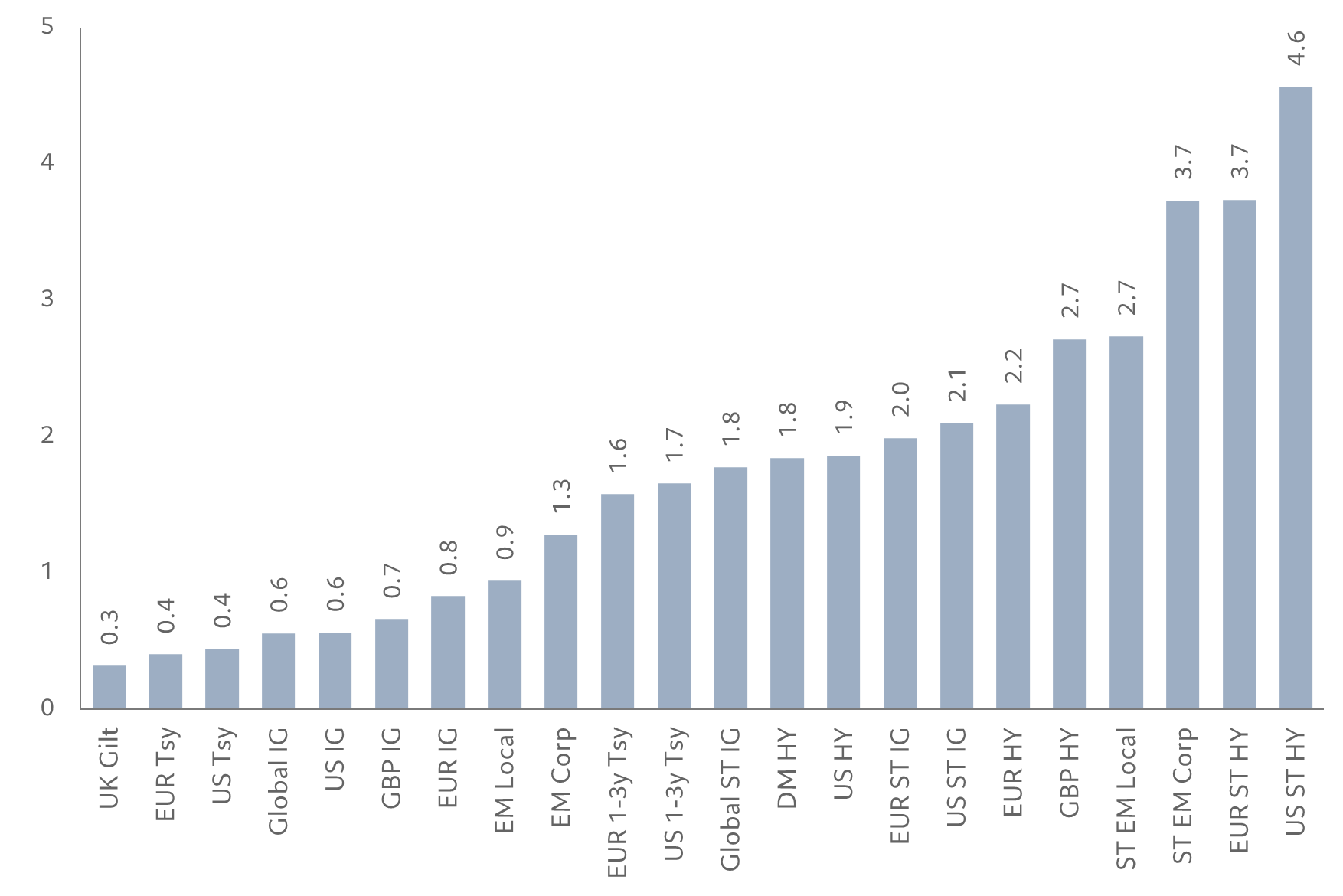

But now, with official rates plateauing and market rates starting to come down as developed economies also start to slow, the most attractive opportunities are spread right across the risk spectrum: in credit, sovereigns and, not least, emerging markets, as well as in money markets and private markets (Fig.1).

Fig. 1 – A universe of yield

Yield to maturity for various fixed income segments, hedged in euros, %

Source: Pictet Asset Management, Bloomberg, ICE Bank of America. Data as at 06.02.2024.

That, though, will take some dexterity. Unlike past cycles, it won’t be enough for investors to buy and hold. That’s because the course of monetary policy is unlikely to run quite as smoothly as the market seems to be anticipating.

For instance, the market has been overambitious in how quickly and deeply the US Federal Reserve is likely to cut rates this year. Inflation is proving stickier than many were hoping, particularly in the services sector. And, in a world of very high government debt loads, substantial fiscal deficits are bound to keep upward pressure on yields.

A monetary policy path of a slow pace of rate cuts and relatively high terminal rates is likely to trigger significant interest rate volatility. With volatility comes dispersion of returns across asset classes and instruments. And dispersion creates a landscape that favours well-informed investors, who then are able to generate excess returns though application of analysis and insight.

Emerging attractions

Emerging market (EM) bonds in particular are poised to be an important, if much neglected, source of excess returns over the coming years. Although returns from the asset class during 2023 were stifled by wild swings in developed market bond yields and disappointment with China’s recovery, there are a number of reasons to be positive about the market for the coming year.

First, the volatility that has roiled even the safest sovereign bonds ought to dispel the notion that developed markets equals stability while EM spells volatility.

Second, China is less important to the market than it once was. Yes, the wider EM market has tended to look to it for a lead – China is a big source of demand for Southeast Asia as well as a major source of tourism revenue – but as these economies have matured, domestic demand has become an ever bigger engine of growth. That, in turn, has been attracting foreign direct investment.

Fig. 2 – Margin of safety

Breakeven rates for various fixed income segments, hedged in euros, %

Breakeven measures how much official interest rates would have to rise in a year before the bonds suffer capital losses. Source: Pictet Asset Management, Bloomberg, ICE Bank of America. Data as at 06.02.2023.

Finally, although there’s variation across the market, EM central banks have by and large been quicker and more aggressive in grappling with the post-pandemic inflationary surge. So where developed market central banks are still waiting to ease, monetary policy has loosened across EM economies. This, together with increasing domestic investment appetite, has made EM local debt increasingly attractive.

Passive risks

Investors grew so used to a lack of dispersion in returns across fixed income and a general lack of yield during the years of quantitative easing and zero interest rates, that passive index-based products became increasingly attractive. After all, when excess returns were hard to come by, it made sense to focus on reducing costs.

That’s no longer the case. Higher yields and significant market dispersion make an active investment approach much more advantageous. When the difference between outcomes is the difference between mid-single digit returns or high single or even double digit returns, the difference in costs between passive and active styles becomes less relevant.

“It’s a new world for investors, one of considerably more volatile inflation and therefore of more volatile interest rates.”

It’s a new world for investors, one of considerably more volatile inflation and therefore of more volatile interest rates. It’ll be one of greater dispersion of performance in fixed income assets. But by that same token, it will be one in which they’ll be able to earn the sort of returns from the bond and credit markets they haven’t seen for many decades – provided investors perform detailed analysis, due diligence and careful risk assessment.