ODDO BHF Asset Management

The US election is leaning towards a clean Republican Sweep (Republican control of the presidency and both Houses of Congress). Such a scenario, if confirmed, would give government the widest scope of action in implementing higher tariffs and lower corporate taxes. Let’s have a look at the potential impact on different asset classes and our positioning.

CONTEXT: DONALD IS BACK

- Presidency: While at the time of publication the result is not yet officially validated, main sources confirm the Trump victory.

- Senate: Republicans have won control of the US Senate amid a slew of victories by allies of Trump, giving them powerful leverage in high-stakes tax and spending battles and the final say in the next president’s executive and judicial nominations.

- House of Representatives: Control of the House of Representatives is not confirmed but polling forecasts suggest a Republican victory.

KEY IMPLICATIONS OF A REPUBLICAN SWEEP

- Fiscal policy and taxes: More expansionary fiscal policy is expected which means an extension of 2017 Tax Cuts and Jobs Act tax cuts and potentially further cuts to corporate taxes (from 21% to 15%) and income taxes. Nevertheless, effective tax rate is already at 17%, lowering the impact especially in comparison with the last move where effective tax rate was much higher (22%).

- Trade and tariffs: A greater focus on protectionist trade policies is expected. Donald Trump has signaled he is willing to introduce a 60% import tariff on China and a 10% on the rest of the world.

- Foreign policy: Greater uncertainty around international relations is expected, particularly towards China, Ukraine, and Middle East.

- Immigration: Donald Trump has promised to carry out large deportation operation and restrict immigration into the US. It would result in a labor supply shock.

OUR TAKE

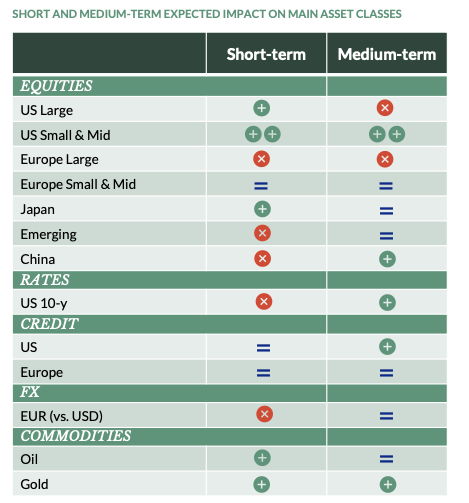

Recent cross asset market dynamics (coincident rise in US equities, US dollar and rates coupled with a lag in Rest Of the World Equities) suggest investors had already incorporated a high probability of Republican sweep. It means that most of the impact is already priced in many assets. For sure, some price adjustments are going to occur in the next few hours. However, current scenario should avoid huge positive/negative surprises in the next few days. The long-term impact on various asset classes is purely theoretical as the timing and sequencing of policy changes will be crucial in dictating the trajectory of asset classes.

OUR ASSET ALLOCATION STRATEGY

- Before opening, we have slightly reduced our exposure to European Equity markets. We are fighting out increasing our small cap exposure in the US as this segment would benefit most of the trump tax rate cut. In addition, US Small Caps are one of the few asset classes that did not price in a Republican Sweep scenario yet.

- We remain constructive on risky assets but do not want to increase exposure at this point without more clarity.

- On duration, we are reaching attractive levels in the European space. We are planning to increase duration with a steepening bias.

POTENTIAL IMPACT FOR US RATES

A larger fiscal deficit compared to all other scenarios and the potential for higher tariffs argue for modestly higher yields across the curve, even if a lot is already priced in. As regards steepening, we expect near term steepening pressures due to a continuation of the repricing of the term premium. Flattening could occur in a stagflation scenario.

POTENTIAL IMPACT FOR US DOLLAR

Trump’s plan to restrict immigration and place tariffs on foreign goods are seen as inflationary, requiring higher-for-longer US interest rates that would support the dollar. Using tariff revenues to lower domestic taxes should act as a fiscal stimulus, which would also support the Dollar. On the long term, we do expect the USD to weaken with the even larger deficit and higher debt to GDP ratio.

POTENTIAL IMPACT FOR EQUITIES

It is widely expected by investors that a Republican Sweep would reinforce US exceptionalism, hence be seen as positive for US equities and negative for European and Emerging Market equities

- US Equities are the big winners of that result. The potential for lower corporate tax rates and other pro-growth policies could prove supportive for US equities, with Small Caps and Cyclical Industrials likely outperforming. Some regulation-intensive industries like Financials and Energy (excluding Renewables) should also outperform. We also expect an outperformance of stocks with high domestic revenue and supply chain exposure. Utilities could be affected if funding for clean energy is partially revoked.

- European Equities are relative losers of this election compared to the US, even if a lot is already priced in, and a weaker euro should benefit to export names and sectors . The negative risk for European Equities points to higher Equity Risk Premium and weaker EPS. Wider risk premia would support European defensive outperformance, particularly for sectors with low US sales exposure like Utilities, Staples and Real Estate. In general, sectors with high US exposure would be under scrutiny given potential tariff hikes (Construction & Capital Goods among Cyclicals, Healthcare among Defensives), with a potential additional burden coming from lost competitiveness versus US peers on lower US corporate tax rates. We also identify downside risk for China-oriented European Technology, given Trump’s hawkish China agenda, and upside risks for European Defense stocks, given scope for an accelerated timeline to ramp up European Defense spending. Financials would likely be a beneficiary of a Republican sweep, given the potential for meaningful deregulation. As regards sectors and geographies, Germany, Italy, Capital Goods, Autos, Beverages, Technology, Chemicals most at risk. The Consumer Discretionary sector could also be at greater risk due to higher foreign revenue exposure and greater import content.

- Emerging Market Equities are negatively exposed to the Republican Sweep scenario. The potential for higher tariffs and increased trade tensions leaves few winners across Emerging Market assets. The ultimate impact, though, would depend on whether tariffs apply to all trading partners or if China is the focal point. Within Emerging Market Equities, North Asia (Taiwan and Korea), China, Mexico, and, to a lesser extent, Brazil equities appear most exposed to higher tariffs. Mitigating factors are the positive impact of the Chinese stimulus, coupled with lower EM currencies, favoring exports.

POTENTIAL IMPACT FOR CREDIT

Lower corporate tax rates and a weaker regulatory environment leads to a marginally tighter spread for both US Investment Grade and High Yield. The impact on European Credit seems marginal to us.

POTENTIAL IMPACT FOR COMMODITIES

Implementation of tariffs could exert downward pressure on global commodity demand, though they could support Gold.