Dong Chen, Chief Asia Strategist and Head of Asia Research Pictet Wealth Management.

Japanese stocks are known for their diversification qualities. Additionally, they provide an opportunity to gain exposure to quality growth firms that benefit from a leadership position in their respective industries. Furthermore, through Japanese equities, investors can position themselves in secular trends such as the fast-growing factory automation sector as well as digitalisation.

Japanese equities in recent years

Since mid-2021, inflation has increased, initially due to external shocks such as pandemic-related supply-chain disruptions and rising energy prices stemming from the Russia-Ukraine war.

Sustained price pressures have led to significant cost-of-living increases, unseen in decades, prompting higher wage demands. Supported by Prime Minister Fumio Kishida’s ‘NewCapitalism’ policy, spring 2024 wage negotiations resulted in an average wage increase proposal of 5%, the most substantial increases in 32 years. Higher wages are part of a broader drive to foster a beneficial cycle of wage and price growth, with the aim to help Japan overcome its long-standing issue of deflation.

On March 19, 2024, the Bank ofJapan ended its negative interest rate policy, raising its benchmark rate from -0.1% to between zero and +0.1%, the fist rate increase since 2007. It also curbed its yield-curve control on 10-year government bonds and stopped buying Japanese exchangetraded and real estate investment funds.In May, Japan’s yearly core inflation rate, which excludes fresh food, rose to 2.5 percent. This marked an increase of 0.3 percentage points from April and represented the fastest rise in two months. These developments offer the Bank of Japan (BoJ) more policy flexibility to normalise its monetary policy. Despite ongoing economic fragility, the bank remains confident of stabilising inflation at around 2% over the next two years. In 2023, Japanese equities outperformed global equity markets, likely boosted by policy support and new capital efficiency measures that encourage more domestic equity investments by Japanese households.

Revival of the Equity Market

Structural challenges leading to the ‘lost decade’ of deflation in the 1990s kept foreign investors away from Japanese equities because of uninspiring earnings growth predictions, a perceived neglect of shareholder interests and low returns on equities. Thus, Japan dropped to 6% of the MScI World Index in April 2024 from 45% in 19892. But an equity revival is under way thanks to reforms introduced by the Tokyo Stock Exchange which have contributed to improving corporate profitability and governance and a new inflation cycle.

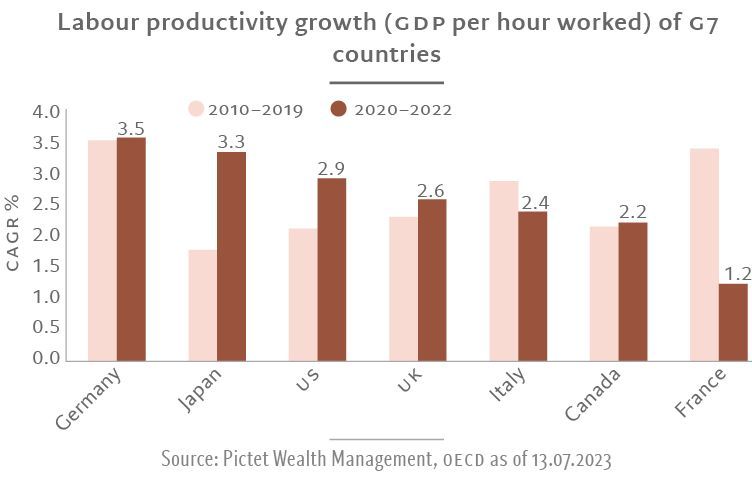

At the micro level, there are also some encouraging signs. Japanese corporate profits have grown substantially since the mid-2010s – not only in absolute terms but also as a percentage of private-sector GDP. Interrupted by covid, the upward trend in profits has since resumed. Labour productivity in Japan has also shown some improvement on both an absolute basis and relative to Japan’s G7 peers in recent years. This may partly reflect the acceleration in government-incentivised digital technology investments since 2018 to combat Japan’s demographic decline.

Since the Abe era (in other words even before the most recent stock market reforms), there has been some notable progress in corporate governance. This includes a new Stewardship Code (2014) and a new Corporate Governance Code (2015), which have helped improve both management quality and capital efficiency. Recent new initiatives by the TSE to address some listed companies’ low valuations have added further momentum to the reforms.

Investor activism is also on the rise in Japan and may contribute to further improving corporate governance. The number of activist campaigns has increased steadily since 2015, rising to a record high of 52 in 2022. This is second only to the US. While it is still difficult to quantitatively assess the impact of all these changes, greater dialogue between companies and shareholders and heightened governance expectations will likely help modify corporate behaviour and unlock corporate value. These policy initiatives are part of the broader pledge by the current prime minister, Fumio Kishida, to transform ‘Japan Inc’ into an attractive investment proposition for foreign and Japanese investors alike.

Diversification

Exports are integral to the revenue streams of many Japanese companies across industries. While this relative dependence on foreign markets makes them sensitive to international economic trends and currency fluctuations it is traditionally considered that Japanese stocks can offer diversification benefits.

Analysing the sector composition of the TOPIX underlines its specificities, including the overweighting of industrial companies and underweighting of technology and consumer discretionary relative to the S&P 500, for example.

Regarding geopolitics, Japan is often seen as an alternative to China – an important consideration at a time of rising Sino-US tensions, which is producing a reshuffling of global supply chains. Japan could benefit from this given its status as a US ally and its strength in high-tech sectors such as electronics and semiconductors. In recent years, the Japanese government has sought to revive the semiconductor industry, with a JPY774 bn (USD6.8 bn) special fund set up under the Kishida administration in 2021 to support cutting-edge chip manufacturing.

Currency-wise, the yen has frequently been considered as a safe haven, tending to appreciate during times of global financial stress. While recent bouts of yen volatility have surprised investors, BoJ Governor Kazuo Ueda has emphasised its commitment to curbing excessive yen declines. The BoJ unique, often contrarian, monetary policies (previously marked by aggressive monetary easing and by the onset of a hiking cycle) represent another source of diversification.

Risks

While the developments outlined are encouraging in the main, the Japanese economy at large continues to face important long-term challenges.

An ageing, shrinking population will likely keep weighing on Japan’s growth potential, hurting a number of domestically focused sectors, not just banks. Investment in technologies to increase productivity and policies to boost labour supply could mitigate the effect, but the headwind remains strong. And despite some relaxation in immigration policies, the number of foreign workers in Japan is still well below the level needed to achieve sustainable economic growth.

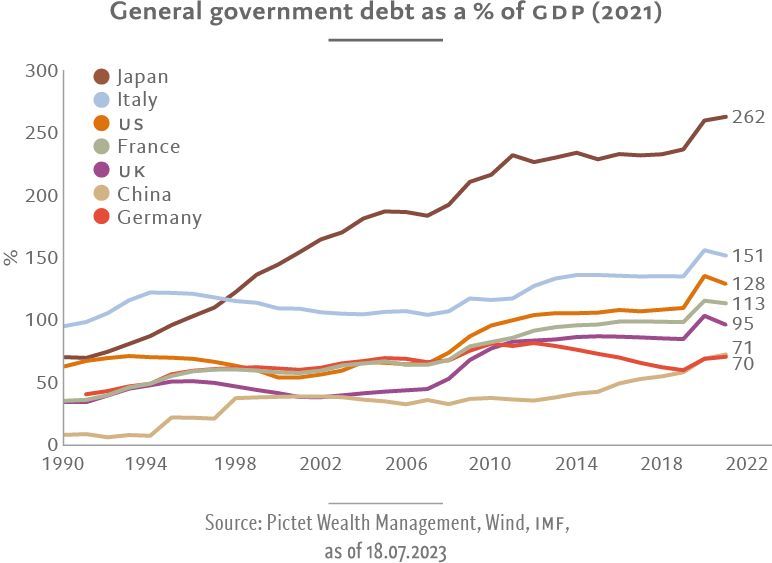

Another concern is the sustainability of Japan’s public finances. Japan’s public debt expanded more than five-fold between 1992 and 2022, making it the most indebted country in the developed world as a percentage of GDP . This has been due to the Japanese government’s large public expenditures since the 1990s to support the economy and the surge in welfare spending as a result of rapid population ageing.

Last but not least, after years of massive monetary easing, how to normalise its monetary policy without causing significant market turbulence that derails the economic recovery remains a daunting task for the BoJ.

Outlook

We expect Japan’s real GDP growth to return to an average of about 0.9% per annum over the next 10 years as the post-covid rebound fades.

After more than a decade of relentless policy easing, mainly on the monetary front, the authorities in Japan are finally closing in on their long-held objective of achieving a sustained annual consumer inflation rate of 2%, partially thanks to the pandemic shock. We believe it likely that the BoJ will gradually head toward policy normalisation in the coming years, raising its main policy rate from the negative level it has been at for years to +0.5% on average, although the process could be long and bumpy.

Japan recorded disappointing growth in Q1 2024, leading us to revise down our full-year GDP forecast from 0.7% to 0.2%. The weakness was mainly due to domestic household consumption and corporate capital expenditure. While exports continued to hold up in nominal terms, thanks to yen weakness, growth was much softer in real terms, and thus net exports were not of much support in Q1 either.

While economic fundamentals do not seem to provide compelling reasons for the Bank of Japan to tighten its monetary policy, sustained yen weakness has caused increasing concerns among Japanese policy makers. In our view, it is therefore increasingly likely that the central bank will raise interest rates further in the coming months.

Relatively generous wage settlements could also convince the Bank of Japan to normalise its monetary policy. Higher wage growth, if sustained, could lead to structurally higher inflation going forward. Japan’s tight labour market pointsin this direction.

Japan’s population has been shrinking since 2009. But Japan’s total employment only peaked on the eve of the pandemic (at around 68 million), largely thanks to the rise in Japanese women’s participation in the workforce following the so-called ‘Womenomics’ drive when Shinzo Abe was prime minister. This involved advancing gender equality and making it more attractive for women to join the labour force. However,this boost may have largely run its course. In 2022, Japanese women’s labour participation rate reached 74.3%, significantly higher than in other major developed economies. In our view, the room for further increases in women’s employment is likely limited. In short, with an unemployment rate of only 2.6% in May 2024, the tight labour market may support higher wage growth in Japan in the years ahead.