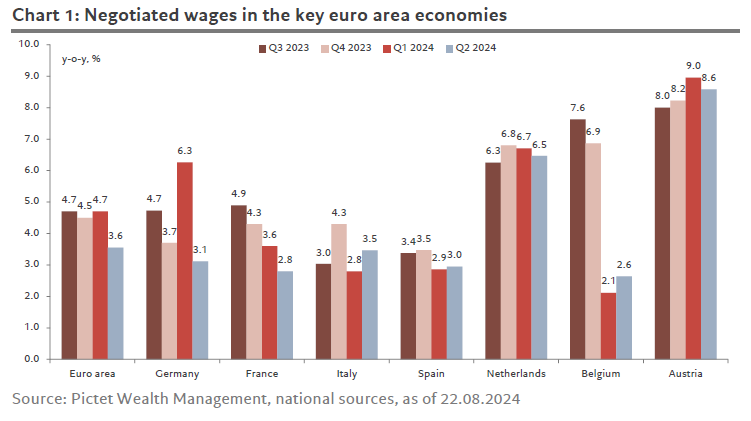

Falling wage growth in Q2 seals deal for September rate cut

Please find below a comment from Nadia Gharbi, Senior Economist for the Pictet Wealth Management Investment Platform and Alan Lemangnen, EU UK Economist for PWM Investment & Pictet Wealth Solutions.

Negotiated wage growth in the Euro area slowed to 3.6% year-on-year in Q2, down from 4.7% in Q1 2024, with Germany being the main driver of the slowdown. Looking ahead, a potential re-acceleration cannot be ruled out in H2 2024 given high trade union demands in Germany but Q1 might still have marked the peak in our view.

Overall, wage growth remains high, but the disinflation process remains firmly on track. In the short term, rising productivity and falling unit profits will help to dampen the upward impact of unit labour costs on domestic prices. In 2025, declining wage growth will be the main driver of further domestic price moderation.

As long as the “wage, productivity and profits” story holds, the ECB might put less weight on specific data points, especially as we could see a renewed acceleration in negotiated wage growth. Thus, we continue to expect the ECB to cut its policy rate by 25bp in September and in December this year, bringing the deposit rate to 3.25% his year, bringing the deposit rate to 3.25%.