Please find below a comment from Nadia Gharbi, Senior Economist at Pictet Wealth Management.

- As widely expected, the ECB left interest rates unchanged at today’s Governing Council (GC) meeting. The Q&A session that followed the decision was largely an “on the one hand, on the other hand” affair: on the one hand, the GC’s confidence that inflation will converge to target over the medium term still seems strong; on the other hand, inflation apparently remains too high, calling for caution.

- In the statement released after the meeting, the ECB judged inflation to be “broadly in line” with the trends outlined in the June staff projections, justifying the status quo. On the growth front, however, it was noted that recent purchasing manager indexes (PMI) pointed to a slower pace of expansion in Q2 and that the risks to economic growth were tilted to the downside (while in June they had been seen as “balanced” in the near term).

- The statement’s comments on short-term inflation were balanced. On the one hand, the sticky core inflation in May was seen as due to “one-off factors”, while most measures were “either stable or declining in June”. The inflationary impact of high wage growth was cushioned by profits. On the other hand, “domestic price pressures remain elevated, services inflation is elevated, and headline inflation is likely to remain above target well into next year”, according to the statement.

- If short-term developments call for caution, ECB President Christine Lagarde seemed more confident about the medium-term inflation outlook. She mentioned that the catch-up in wages will mostly play out this year due to the delayed and diffuse wage bargaining processes in Europe, but that wage growth should moderate in 2025 and 2026. Moreover, she pointed out that the decline in unit profits has helped absorb part of the increase in unit labour costs and muffled domestic price dynamics. Looking ahead, this should be reinforced by rising productivity as the recovery takes hold.

- When asked about a possible rate cut in September, Lagarde declined to commit in advance, saying that “what we do in September is wide open” and stressing that the ECB remains data dependent. It is worth noting that markets are pricing in an 80% chance of a rate cut in September. In this context, it was interesting to hear Lagarde stress that the GC had unanimously agreed with the Chief Economist’s proposal to leave rates unchanged today and that the assessment was based on market expectations for future interest rates, which include three rate cuts by mid-2025.

- Overall, the ECB is sticking to its data-driven, meeting-by-meeting approach. Key data releases to watch over the summer include PMI and inflation reports for July and August, as well as negotiated wage data on 22 August.

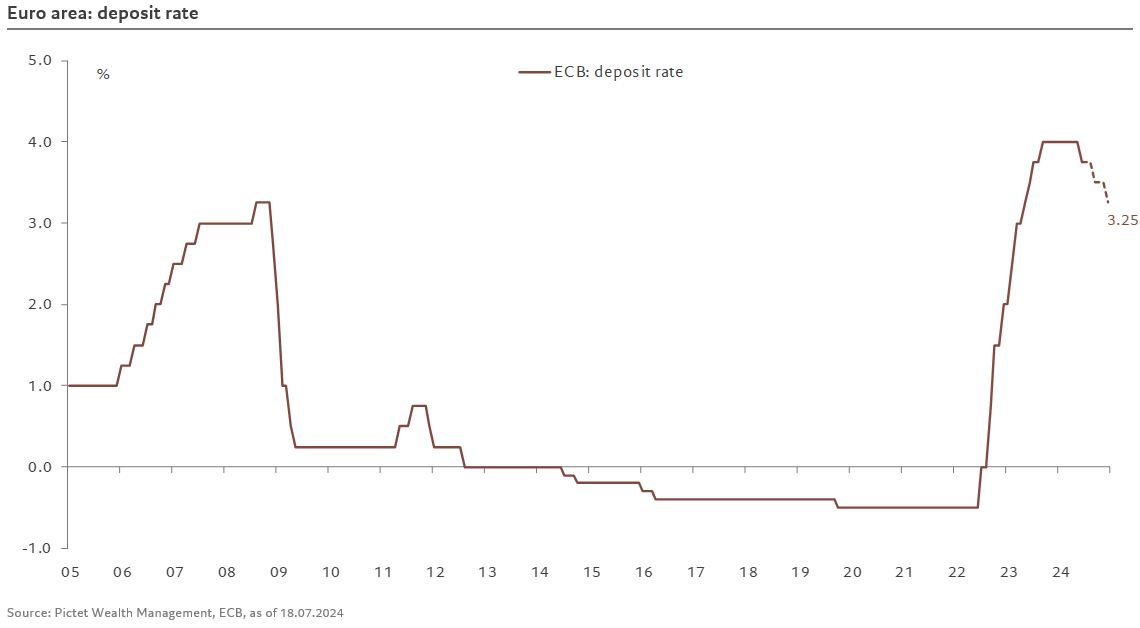

- We continue to believe that, barring any major surprises in incoming data and changes to the staff projections, the ECB will cut rates again in September and December, bringing the deposit rate down to 3.25%.