Take advantage of the turmoil in the bond markets to build a position.

Since the results of the European elections in France showed a massive victory for the far-right, and the subsequent announcement by President Emmanuel Macron of the dissolution of the French National Assembly, it has been all hands on deck in the European stock and bond markets. The market fears that the upcoming French elections will cause a shift in power that will further derail France’s public finances. In the bond markets, French interest rates and the spread with German government bonds have risen. This may be a good time to start taking a position in French government bonds because things are never as bad as they seem. If you still find it too risky, you can diversify the risk by also buying Spanish government bonds. Spanish interest rates are still relatively high while the Spanish economy is among the strongest in the EU.

French Turmoil…

In recent days, France has been shaken. For the European elections, the far-right party Rassemblement National garnered 31.4% of the vote, prompting President Emmanuel Macron to immediately dissolve the National Assembly or the House of Representatives and call new national elections for June 30 and July 7. The elections will be held in two rounds. As the president’s party loses popularity, many, including the financial markets, fear a victory for the far-right Rassemblement National (or far-left). This would not bode well for France’s financial situation as the extreme parties want to reverse many of Macron’s austerity measures and loosen financial reins at a time when France’s government debt has risen above 110% of GDP and a budget deficit of 5.1% is expected for 2024.

In the bond markets, it was all hands on deck, and the 10-year French benchmark interest rate rose from 3% to above 3.20%, the highest level since October 2023. Moreover, the spread between French and German paper rose to about 80 basis points or 0.8% (see chart below, black line, right scale).

The last time the spread between the 10-year French and German interest rates was this wide was in 2017. Specifically, this means that the risk perception of France relative to Germany has increased significantly, and bond investors are demanding extra compensation for comparable paper from the two countries. Bond investors are indeed fearful that public finances will spiral out of control and the risk of default will increase.

…and Spanish Calm.

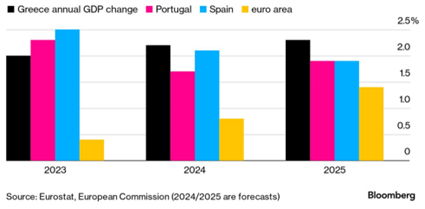

Interestingly, the spread between the German 10-year rate and the rate of other European countries also widened due to the French turmoil, even though it will not affect those countries’ finances. For instance, the spread between German and Spanish government bonds rose to over 90 basis points (red line in the chart, right scale) and nearly 160 basis points for Italian paper (blue line, left scale). For Spain, this is strange because the Iberian country has emerged this year as a market favorite thanks to an economic recovery and a strong reduction in public debt. The sharp decline in this spread since the fall of 2023 until the recent spike is clear evidence of this. Spain, with a 10-year rate now at 3.35%, has simultaneously narrowed its interest rate differential with France. The gap is now less than 20 basis points, the smallest since the global financial crisis in early 2008.

That Spain has become a favorite in the bond markets was unthinkable a decade ago when it was still part of the disrespectful PIGS or Club Med club (including Portugal, Italy, and Greece) and struggling with a recession and skyrocketing (youth) unemployment. The roles have now reversed. Spanish economic growth is expected to be around 2% in 2024 and 2025, much higher than the low European average.

The budget deficit should fall below the ECB’s target of 3% this year compared to a deficit of 3.8% in 2023. Public debt stands at 107% of GDP, still high but much lower than the 125% of early 2021. Youth unemployment has also significantly decreased from 58% in 2014 to 26.5% in April 2024. The numerous reforms implemented are finally starting to bear fruit, although there is still work to be done, such as in the area of inflation (still 3.2% today). In summary, financial markets today see Spain as an economy that is getting its house in order, with indicators moving in the right direction. For bondholders, the average risk has significantly decreased over the years.

Combining Both

In a well-diversified portfolio and/or savings plan, there should be room for bonds, including European government bonds. The most logical choice would be to buy German government bonds, but they yield little because Germany has the highest credit rating and is used as a base by many institutions. Moreover, Germany’s recent economic outlook is less favorable, and this higher risk is not adequately compensated today.

It might be a good time to take a position in French government bonds because things are never as bad as they seem. Even the political party Rassemblement National was somewhat taken aback by the market turmoil and promised to make concessions if they won the elections. If you still find it too risky to include only French government paper in your portfolio, you can spread the risk by also buying Spanish government paper, thus combining European growth with stagnation (from France) to some extent. Despite the improved state of the Spanish economy and above-average EU growth, the Spanish 10-year interest rate remains relatively high.

At Trade Republic, two trackers are available that can be purchased to invest in French and Spanish government bonds, respectively. You can evenly divide your investment between the two trackers. Both can be included in a savings plan.

- Now that there is turmoil in the French bond markets, you can buy this ETF, which cost almost 135 EUR at the beginning of the year, at a much lower price today. The rise in French interest rates has caused a drop in the price. This tracker closely follows the Bloomberg France Treasury Bond index, which consists of 55 French government bonds of various maturities (from 1 year to more than 20 years). As it is a distribution ETF, coupons are paid out regularly, semi-annually (June and December). At the beginning of June 2024, 1.41 EUR gross was paid out, and in December 2023, it was 1.25 EUR gross.

- Due to the recent rise in Spanish interest rates, you can also buy this tracker at a slightly lower price than a few weeks ago. This tracker follows the Bloomberg Spain Treasury Bond index, which consists of 56 Spanish government bonds of various maturities (from 1 year to more than 20 years, with a focus on 3 to 5 years). As it is a distribution ETF, coupons are paid out regularly, semi-annually (June and December). At the beginning of June 2024, 1.36 EUR gross was paid out, and in December 2023, it was 1.12 EUR gross.