Luc Luyet, Currencies strategist, Pictet Wealth Management.

Robust global demand

Although gold prices are at historical nominal highs, the decline in price-sensitive

gold demand has led to weaker price momentum since mid-April.

In the short term, we see limited scope for a significant decline in demand and

therefore we are adjusting upward our three-month projections to USD2,350 per

troy ounce. Our 12-month projection is USD2,550.

While price momentum could remain relatively subdued in the short term, we

expect demand to strengthen in the medium term thanks to a rebound in ETF

demand and renewed Chinese physical demand.

GOLD DEMAND REMAINS HEALTHY

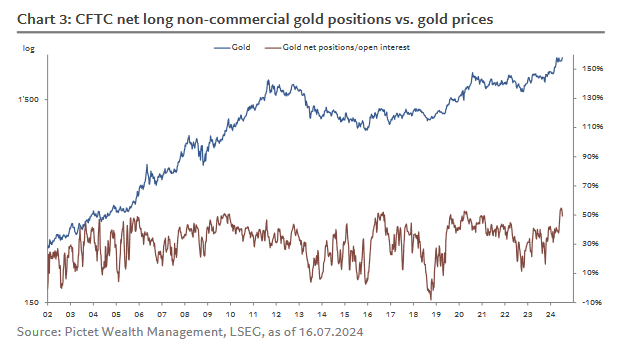

Gold prices have stabilised at historically high levels since mid-April. But demand

momentum has slackened because of the high prices. In particular, the reduced af-

fordability of gold and unsupportive seasonality should ensure jewellery demand

remains weak until end-August. Central banks with long-term goals to increase

their gold allocation may also decide to wait for more attractive prices. Finally, Chi-

nese physical demand for gold, as proxied by the spread between the international

(London) gold price and the gold price on the Shanghai gold exchange, has abated

recently (chart 1).

But other sources of gold demand have been holding up. For example, ETF demand

has improved thanks to rising chances that the Fed will start its easing cycle in Sep-

tember, while demand from futures markets has remained strong. In addition, re-

ported demand from central banks is only a portion of official demand. While little

is known of current buying, institutions such as sovereign wealth funds eagerly

bought gold in Q1.

Overall, although we have seen a relatively mild decline since mid-April, there is lit-

tle evidence that high gold prices have significantly dented global demand for the

yellow metal, meaning the bullish case for gold remains intact.

ETF AND CHINESE DEMAND LIKELY TO STRENGTHEN

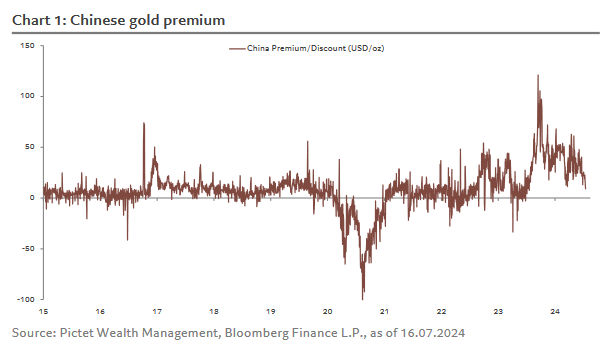

Beyond ongoing strong demand from the official sector, there are two main reasons, in our view, to keep a medium-term positive view on gold. First, we see scope for further improvements in ETF demand after months of disinvestment. The start of a Fed easing cycle should fuel some of this demand for gold as the opportunity costs to own gold would likely decline in line with interest rates (chart 2).

Second, Chinese physical demand for gold is likely to strengthen again. Depending

on who the next US president is, the threats of higher tariffs on Chinese exports to

the US could lead to downward pressure on the renminbi and therefore fuel

stronger Chinese demand for gold. Besides the US elections, the Chinese economic

outlook remains subdued and domestic monetary policy is unlikely to be tightened

soon given low inflationary pressure. The policy mix is therefore not supportive of

the renminbi. The increasing number of countries considering curbs on Chinese ex-

ports may also add to the downward pressure on the renminbi. Overall, we expect

Chinese demand for gold to pick up again in the coming quarters.

The US elections may in reality have a mixed impact on gold prices. Because neither

presidential candidate has made a strong case for fiscal consolidation, growing concerns over the US’s fiscal sustainability may eventually favour gold, which does not bear any default risk. But Donald Trump’s proposals for higher tariffs and reduced immigration could lead to significantly higher inflation and higher interest rates, which may weigh on gold prices through punitive opportunity costs.

GOLD’S MEDIUM-TERM OUTLOOK REMAINS POSITIVE

Our 12-month projection of USD2,550 per troy ounce symbolises our medium-term

bullish outlook on gold (the spot price was USD2,422 on 15 July). However, histori-

cally high nominal prices are cutting into demand at present and may mean that

gold has little upside potential in the short term. It is also worth noting that prices

for other precious metals are currently less robust than for the yellow metal. We

suspect that the recent fall in US short-term interest rates and the US dollar has

been helping gold prices resist. Given our central scenario, gold may not benefit

much more from these two drivers in the short term.

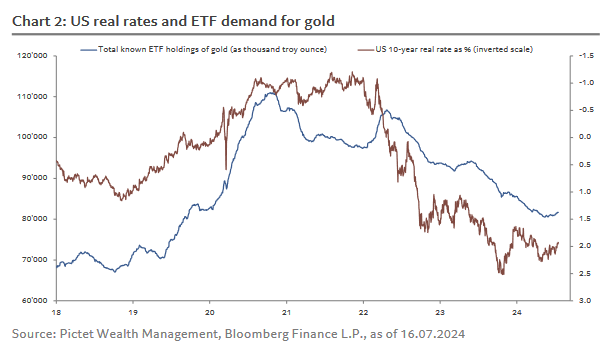

The key risk is obviously that new all-time highs in the gold price kindle another

rise in demand from momentum investors. But unlike March (when gold prices

surged), positioning in the futures market is already at very elevated levels (chart 3)

suggesting marginal new demand may be limited. That said, we acknowledge that

with the Fed easing cycle and US elections getting closer, a strong decline in gold

demand looks increasingly unlikely. As a result, we are revising our three-month

projections to USD2,350 per troy ounce (vs. USD2,240 previously).