You will find below a commentary by Frederik Ducrozet, Head of Macroeconomic Research, at Pictet Wealth Management, ahead of this Thursday’s ECB meeting.

With a majority of Governing Council (GC) members now seemingly united behind a first rate cut in June, this week’s meeting will largely be about the GC confirming its growing confidence that inflation will return to 2%, a necessary condition for starting the easing cycle.

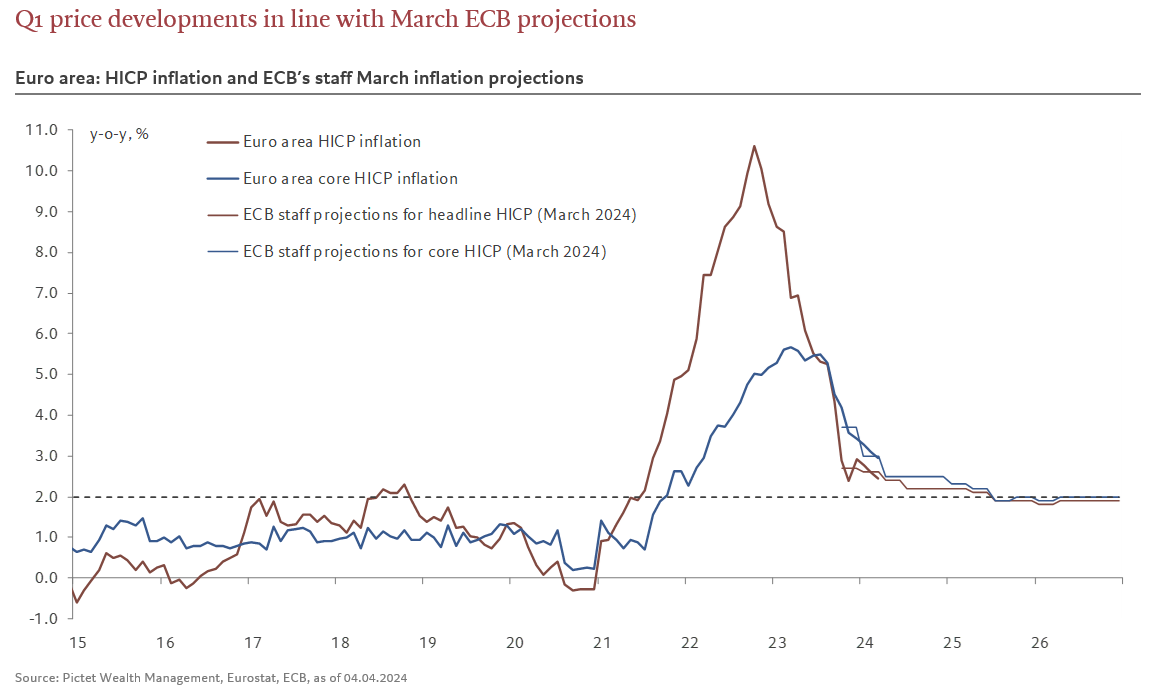

March’s inflation data confirmed that the disinflation process is on track, in line with the latest staff projections (see chart below), providing the GC with the first “piece of evidence” it needs to see for a rate cut, in line with Lagarde’s explicit guidance.

However, the second piece of evidence needed is still awaited: a confirmation of the moderation in wage growth, on which the negotiated wage growth print for Q1, to be released on 23 May, a few days before the June meeting, should provide more information (hence Lagarde’s “we will know a bit more in April, a lot more in June”).

Against this backdrop, we expect the ECB to remain on hold this week while adopting a dovish tone, setting the stage for the start of the easing cycle in June (barring any upside surprises on wages), potentially fueling expectations of successive cuts to follow (although the GC is unlikely to commit to a specific path rate). We still see a total of 4 rate cuts this year, totaling 100 bps, bringing the deposit facility rate down to 3% by the end of the year.