Immediate market impact of policy changes should be muted.

By Dong Chen, Chief Asia Strategist and Head of Asia Research at Pictet Wealth Management.

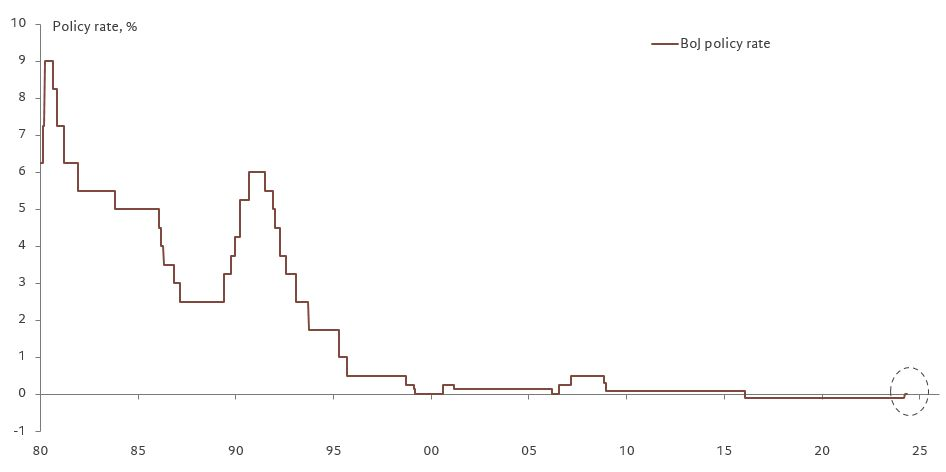

On 19 March, the Bank of Japan abandoned its negative interest-rate policy, announcing a rise in its benchmark overnight rate from between -0.1% and zero to between zero and +0.1%, the first time it has raised rates since 2007. The Bank also lifted its yield-curve controls—a policy put in place in 2016 to cap yields on 10-year Japanese government bonds (JGBs)—and said it will discontinue purchases of Japanese exchange traded funds and real estate investment trusts.

Having been well signalled, we believe these decisions should have relatively mild market consequences in the near term. Put simply, they enable the Bank of Japanese (BoJ) to get out of a corner while at the same time avoiding excessive tightening financial conditions. Anxious to minimise the market fallout, it gave no indication of further rises in interest rates. For our part, we expect no further rate rises this year.

While the latest moves will provide extra policy flexibility to Japan’s central bank, it will maintain an accommodative policy stance through its substantial JGB purchases, which are set to remain at “broadly the same amount as before” (about 6 trn yen (USD40 bn) per month). It has left open the option of re-imposing some sort of yield-curve control should the need arise and of increasing the quantity of its JGB purchases in case of a rapid rise in long-term rates.

Both the continued bond purchases and lack of guidance toward further tightening reflect the Japanese economy’s ongoing fragility despite upward revisions to growth figures over the past two quarters that meant it avoided a technical recession. Nevertheless, despite some recent weakening in core inflation, the Bank of Japan said it was confident that its target of 2% inflation “would be achieved in a sustainable and stable manner” over the next two years. This view was likely reinforced by the hefty wage increases workers at large firms obtained in recent pay negotiations.

Yield-curve control had already been relaxed since October 2023, when the BoJ announced that its 1% cap on 10-year JGBs would be a reference rather than a hard upper limit. Since then, there has been a steepening of the JGB yield curve that has benefited Japanese banks. The abandonment of the BoJ’s negative interest-rate policy will remove its distorting effects on banks’ profitability, which will now earn interest on their deposits with the central bank.

Overall, however, containing few surprises and little by way of forward guidance, we believe the 18 March announcements should not derail the rally in Japanese equities, nor do we see them having a huge impact on the Japanese bond market. Given the large rate gap with the US, and the BoJ’s commitment to maintaining an accommodative stance, it is Federal Reserve policy that will likely determine the yen’s performance against the US dollar. We would expect the yen to strengthen sustainably only after the Fed has started to cut rate.

Source: Pictet Wealth Management, Bank of Japan, 19 March 2024