You will find below a commentary by Xiao Cui, Senior Economist at Pictet Wealth Management, reacting to yesterday’s Fed meeting.

The FOMC boosted its growth and inflation projections, but the median dot for 2024 stayed at three cuts. This says a lot about the Fed’s reaction function and indicates a clear bias to cut rates this year. Powell downplayed the recent inflation uptick, noting the Fed’s view of inflation coming down on a bumpy road has not changed. He refrained from giving specific guidance on the start date or the pace of cuts but repeated that cuts are likely at some point this year.

We still have June as our base case for the first cut. The risk to our Fed call of a June start and 125bps of cumulative cuts are clearly tilted towards a later start and fewer cuts. If inflation fails to moderate in March, that would significantly reduce the odds of near-term policy easing. We differ from the Fed in our view about growth and the labor market, as more than expected weakening would lead to more easing than the Fed currently anticipates. The committee will also be increasingly sensitive to labor market weakness.

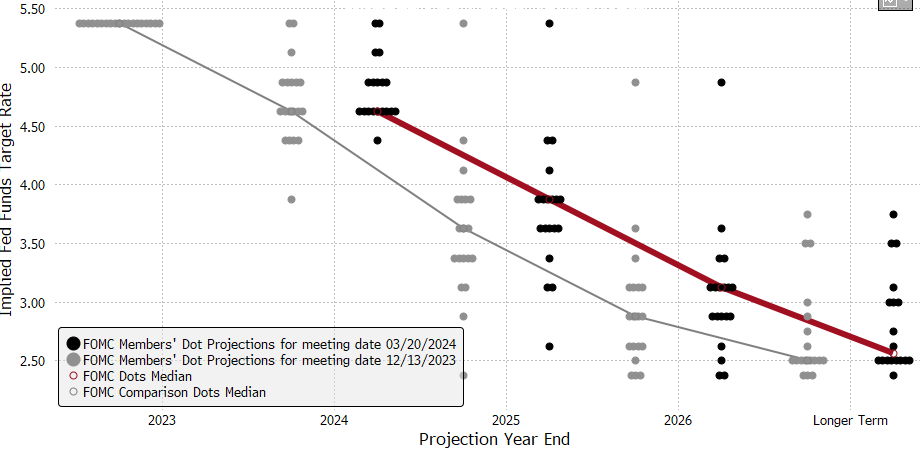

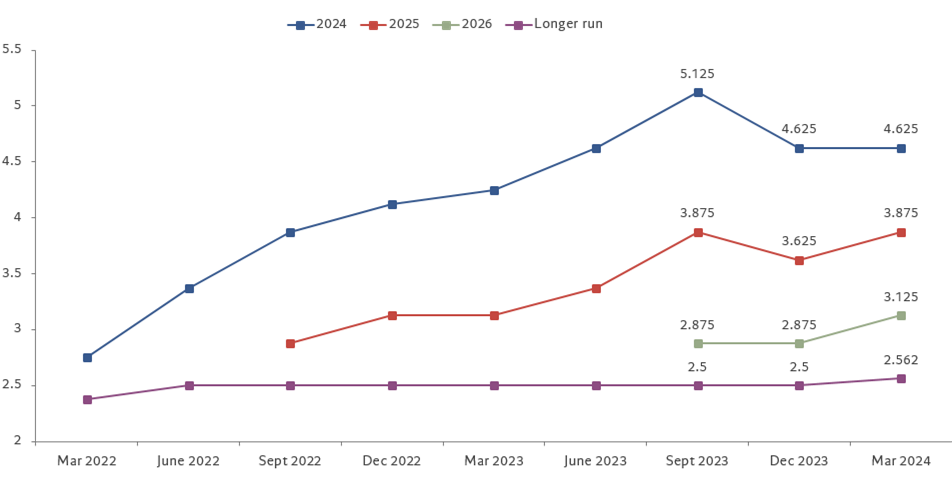

Three cuts for 2024. The median dot continued to show 75bps of cuts in 2024, as we expected, although consensus was split between the median showing 75bps or 50bps of cuts. The margin is thin with 10 showing 3 cuts or more (vs.11 last time) and 9 showing 2 cuts or fewer. We believe Powell is in the 3-cut camp.

Higher for longer. The median dots for 2025 and 2026 were each revised 25bps higher, to 3.875% and 3.125%, respectively, consistent with three cuts each year. The longer-run median moved just slightly higher to 2.6% from 2.5%. It has taken the FOMC surprisingly long to come to the view that the neutral rate is likely higher, especially the short-run neutral rate.

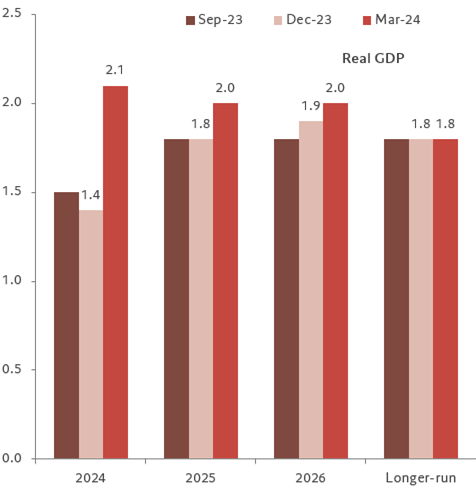

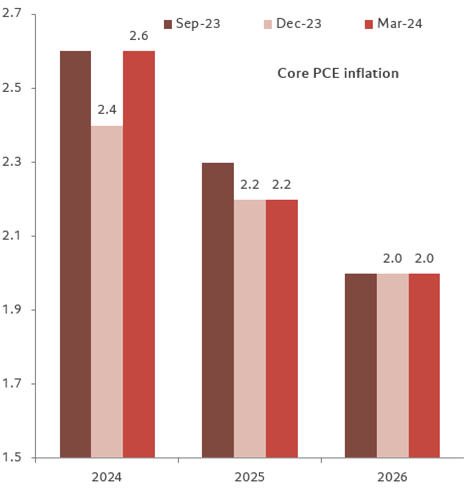

Supply expansion. For 2024, the FOMC forecasts significantly higher GDP growth (+0.7% to 2.1%) and slightly higher core inflation (+0.2% to 2.6%). Chair Powell noted the upgrade to GDP was mostly due to an expansion of labor supply as a result of immigration. We have noted immigration is expected to remain high this year after surging last year, with significant impact to labor supply, wage growth, shelter inflation, and productivity growth.

June still on the table. Powell repeated his prior comment that it is still likely appropriate to cut at some point this year. Despite many attempts by the press for a more specific guidance, Powell didn’t commit to future moves. We still have June as our base case for the first cut, with the risk of a delay to July. If inflation is strong enough to prevent the Fed from hiking before July, the September FOMC meeting would be too close to the election for a first move in the policy stance.

Inflation view not changed. Powell noted the strong Jan/Feb inflation numbers haven’t changed the inflation story which is that of inflation moving down gradually on a sometimes-bumpy road toward 2%, but he doesn’t want to be dismissive of the data. He noted there are reasonable seasonal effects in the numbers (our reading of the data as well). We have two more CPI reports before the June FOMC and they carry significant importance.

Risks to the outlook are two sided. Powell mentioned at multiple points the risk of employment unexpectedly weakening. The committee is very much sensitive to employment weakness and if there were to occur (not their base case), they would require rate cuts. In a dovish comment, Powell also noted strong job growth, in and of itself, is not a reason s to be concerned about inflation

QT coming fairly soon, and possibly slower for longer. Powell noted the tapering of Treasuries is coming fairly soon. We read this as meaning an announcement of tapering in May, in line with our previous expectation. This does not necessarily mean the balance sheet would shrink by less than otherwise as the committee wants to approach the ultimate level more gradually, i.e. slower for longer.

FOMC dot plot Mar 2024 vs. Dec 2023

FOMC median dot evolution

FOMC economic projections