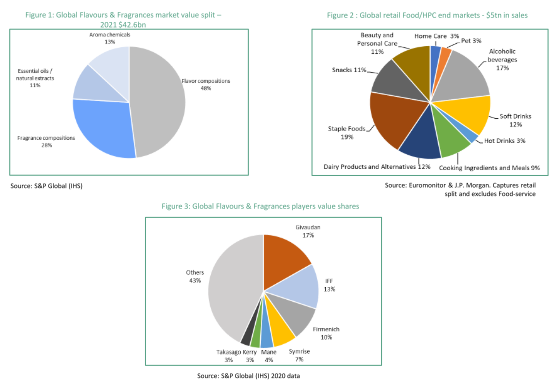

Flavours, fragrances, ingredients, extracts and odours…. of chemical or natural origin, which are widely used in the food and beauty sectors, represent a global market worth around €40 billion and are likely to grow at an average rate of 4% a year over the next few years, according to many experts. They also expect the consolidation trend to continue, given the growing need to be able to supply complete solutions (flavour, odour, ingredients, technology) to major manufacturers.

Flavours and odours of chemical or natural origin, which are widely used by the food and beauty industries, represent a global market worth €40 billion. It is more or less equally divided between the nutrition segment, dominated by the Asia-Pacific region (31% of the food/beverage market), and the fragrances and beauty segment (with Asia-Pacific accounting for a similar share).

Many experts agree on the growth prospects for this segment, which has seen only one negative year in the last 15. In 2020, sales of flavours fell by just over 2% in volume terms (up 4% for fragrances), but growth has been between +2% and +8% since 2009. For its part, JPMorgan expects 4% growth over the next few years, including a 2% to 3% volume effect, driven mainly by emerging countries.

This market is characterised by the presence of 4 industrial giants (Givaudan, IFF, DSM/Firmenich and Symrise) which together account for almost 50% of the market. These players are characterised by very strong innovation policies, resulting in R&D budgets of between 5% and 8% of sales. However, a number of small caps are also present on this market, such as France’s Robertet (a specialist in natural extracts and essences with sales of €740m and an EBITDA margin of 18%) and the UK’s Treatt (£150m sales, EBITDA margin of 29%).

NEW SEGMENTS DRIVE MARKET GROWTH

In the world of flavours, new segments are driving growth in the sector, such as food and food supplements for pets, energy drinks and plant-based foods. The flavours segment is also set to benefit from megatrends in healthy, environmentally-friendly nutrition and the humanisation of pets.

JP Morgan, for example, estimates growth of 7% in value (+4% in volume) in pet food over the next few years, with more and more components being added to the product range:

- The attractiveness of food (palatability) in terms of smell, taste and texture;

- Nutrition, with the aim of improving the nutritional characteristics of products;

- Product durability to ensure that intrinsic qualities are preserved over time.

Plant-based foods have even stronger growth prospects, according to Ireland’s Kerry Group, which forecasts a CAGR of 12% over 2021/2026, driven by consumers’ desire to use increasingly natural ingredients.

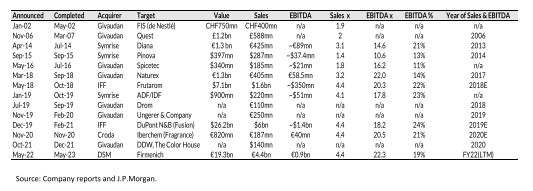

FURTHER CONCENTRATION OF THE SECTOR IS LIKELY

The sector has undergone a major wave of consolidation in recent years, with mega-mergers such as the one between IFF and Dupont finalised in 2021 (2022 sales of $12bn) and, more recently, the one between DSM and Firmenich in 2022 (sales of over €11bn). Givaudan and Symrise have also carried out a number of acquisitions over the past 20 years, but with smaller targets at this stage.

FLAVOUR & FRAGRANCE HISTORICAL M&A (LARGER DEALS ONLY)

While the search for synergies has regularly motivated these mergers, the desire of these groups to be able to offer an integrated model also explains these operations. More and more players are tempted to offer products that combine their expertise in flavours and odours with nutritional and functional characteristics and bioscience specialities to provide a complete offer to end customers (as opposed to just ingredients). This objective can be seen, for example, in the merger between Germany’s Symrise and Swedencare, a Swedish group specialising in health products for pets.

Discover the full Fund Insight of ODDO BHF AM here.