Today, investors can no longer ignore artificial intelligence (AI) and ChatGPT’s sudden breakthrough is no stranger to this. AI is on the priority list of a lot of companies from all possible sectors and many hope to make solid productivity gains with it over time. Meanwhile, more and more investor money is also flowing towards AI and, despite the current hype, it is not too late for a long-term investor. However, picking out the winners of the AI hype is no easy task: an ETF can provide solace.

Growth undeniable

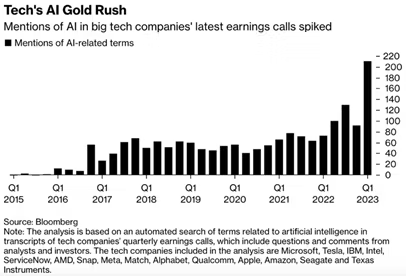

That more and more companies are working on AI in one way or another is easy to demonstrate. The latest quarterly figures from the 15 largest US tech companies counted how many times AI was mentioned, and in Q1 it was almost three times more than in Q4 of 2022 (see chart below).

The number of applications is also growing exponentially. Before 2022, AI was mostly B2B-focused and not really visible but today, because of ChatGPT, AI has broken through everywhere, including our daily lives. ChatGPT went from 0 to 100 million users in a matter of weeks. Never before did the adoption of any technology happen so fast. Some now even speak of the democratisation of AI, also sometimes referred to as the iPhone moment of AI. The iPhone brought the internet to the palm of your hand and ChatGPT is now doing the same with artificial intelligence.

We can no longer ignore the fact that AI is creeping into just about every company and business model. Artificial intelligence will therefore revolutionise all sectors and regions and change the way we work. However, the speed at which AI will have an impact differs per sector. Forerunners today are the transport and logistics sector, biotech and biopharma, internet and media, but other sectors are rapidly catching up.

Investing

Notwithstanding AI’s breakthrough in the stock market in recent months, there is certainly still potential. Investors should also not lose sight of the fact that the current price jump came after the disaster year 2022 when the technology market, and also the AI segment, lost some 30% of its value. On top of that, we are only at the early stages of the breakthrough and the disruptive power of AI has only just been unleashed. Some even argue that “the creation of the internet was the appetiser but artificial intelligence will be the main course.

It therefore seems logical that in any well-diversified portfolio there should be a particle of AI. The percentage of the total portfolio that can be set aside for this will depend on the risk profile and appetite of the investor in question. Searching for the ultimate AI stock or even putting together a basket of AI stocks by yourself, however, is no easy task. It is a specialised technology where the AI impact of each company individually is difficult to estimate. Therefore, the best choice is to capitalise on the theme via an ETF. Indeed, one then buys a complete portfolio consisting of dozens of AI stocks, spread across all sectors and with the necessary diversification.

Which ETFs?

Despite the growth in popularity of AI in general, there are not that many ETF ‘s grafted on it today. We suspect that this will soon change given its current popularity. At Trade Republic, there are three AI trackers to choose from, each of which capitalises on both AI and robotics. Robotics is closely linked to artificial intelligence because thanks to AI, robots have become more intelligent and can therefore perform many more tasks in a better way.

First in line is the ETF Artificial Intelligence USD (Acc) issued by WisdomTree. The tracker closely tracks the Nasdaq CTA Artificial Intelligence and Robotics index. It is a well-diversified index consisting of 107 different names: all names that have anything to do with AI are in it. The technology sector accounts for 52% but the industrial sector is also well represented at 29%. The index started on 18 December 2017 with a base value of 1,000 and today hovers around 1,600 points.