US election countdown – America First vs. continuity

Please find below a new comment from Xiao Cui, Senior Economist at Pictet Wealth Management, and the CIO research team, ahead of the upcoming US election

- With just 18 days until Election Day, Trump and Harris remain in a dead heat. We continue to expect that a Harris victory is likely to result in a divided government due to Republican advantages in the Senate. If Trump wins, a Republican sweep is slightly more likely than a divided government due to tight races in the House of Representatives.

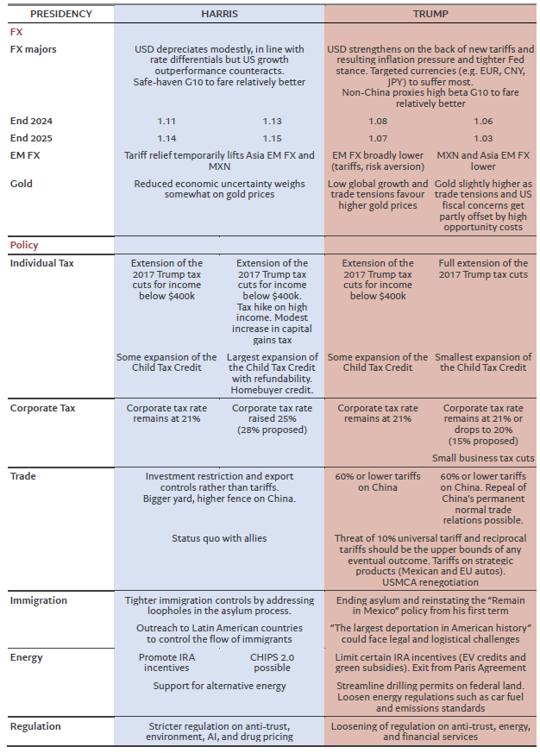

- A Republican sweep would encourage America First reflation trades due to tax cuts and higher spending, while a Trump win with a divided government would imply trade war 2.0 with potential growth downside not offset by fiscal stimulus. A Harris win with a divided government would largely represent continuity, while a Democrat sweep would lead to higher taxes on corporates and high-income households, but also higher social spending.

- Trump’s policies on taxes, trade, and immigration are expected to be more inflationary than those of Harris. We expect increased macroeconomic uncertainty and a more combative stance on trade, with higher tariffs and restricted labour supply.

- A benign moderation in the labour market and a soft landing in the economy remain our base case, with the Fed lowering rates to neutral, around 3-3.25%, in 2025. However, a Trump presidency is likely to trigger more hawkish monetary policy and a reassessment of the terminal rate for the cutting cycle.

- In this note, we break down the election’s potential impact on the economy and markets, and discuss the current state of play, the timing of election results, and key post-election risks.