Powell describes a 50bp rate cut as recalibration, but he shows a pre-emptive reaction function

Below you will find a new comment from Xiao Cui, Senior Economist, at Pictet Wealth Management, in reaction to last night’s Fed meeting:

Contrary to what we expected, the Fed opted to cut its policy rate by 50bps, instead of the more traditional 25bps. Governor Bowman dissented in favor of 25bps, the first dissent from a governor since 2005. This was a major win for Powell – the committee was likely leaning towards 25bps, but Powell had a preference for 50bps and ended up successful in persuading most of the voting members to get on board.

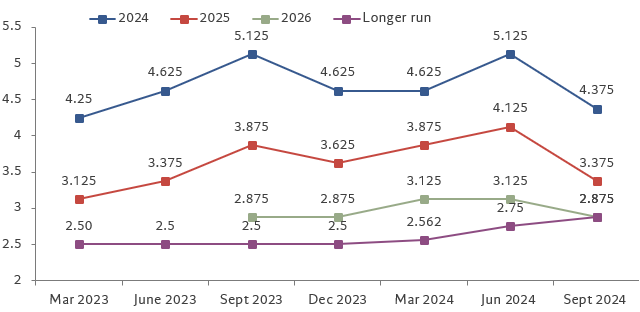

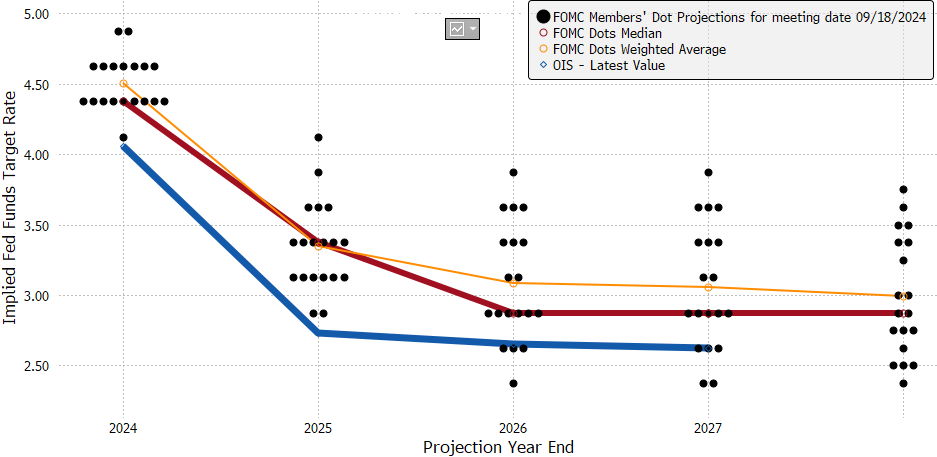

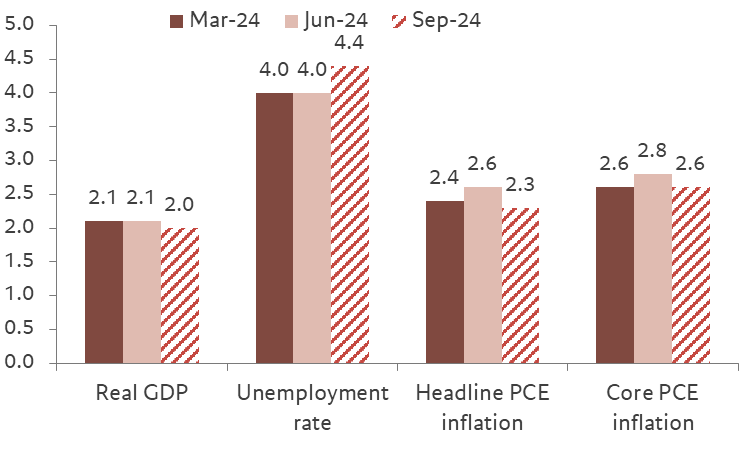

Interest projections were lowered significantly from June, but they remain above market pricing – the median dot showed 50bps more cuts in 2024, suggesting 25bps each at the Nov and Dec meetings. The median shows 100bps of cuts in 2025 to 3.375%, and 50bp of cuts in 2026 to 2.875%, in line with the median participant’s estimate of the neutral rate. The economic projections showed a higher unemployment rate and a lower inflation path in 2024-2026. There was minimal change to the committee’s longer-run estimates. Markets reacted initially in a dovish direction, but reversed course as the presser went under way.

Chair Powell described the choice for a larger rate cut as policy recalibration, essentially a mea culpa for skipping July. If the Fed had the July employment report on hand at the last meeting, they likely would have cut by 25bps then. Powell pushed back several times against the idea that 50 will be the new 25, noting that the Fed is not in a rush to lower rates and no one should look at 50bps as the new pace. Contrary to past easing cycles with a large initial cut, Powell remains overall upbeat about the labor market, and sounds very confident about inflation returning to target over time. But he did choose to emphasize the benchmark downward revisions to nonfarm payrolls from the QCEW data, and anecdotal data from the Beige book which show a slowdown in hiring (not layoffs).

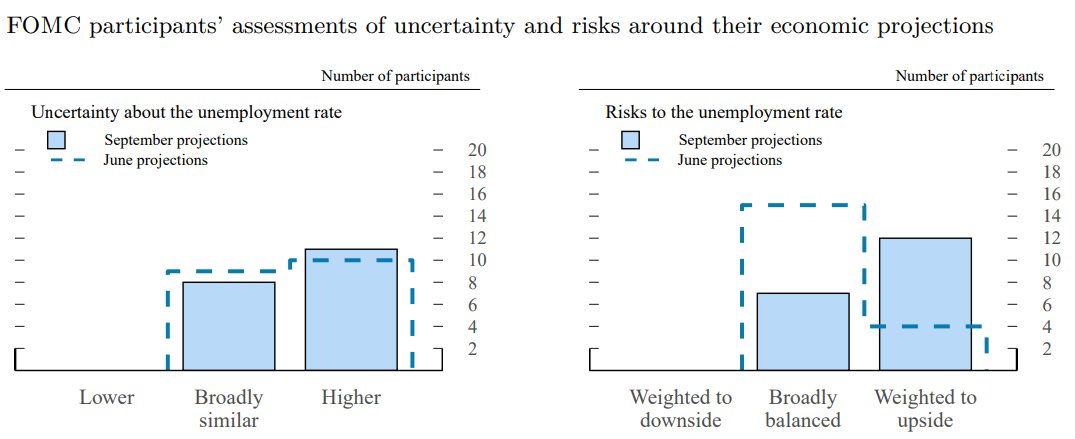

Our takeaway is that the Chair is hell-bent on securing a soft landing and has a more dovish reaction function than we expected. He noted that the time to support the labor market is when it’s strong, and the Fed won’t be waiting to see layoffs to give that support. He describes the labor market as solid and notes that he wants to keep it there. Powell referred to the Beveridge curve, noting that further declines in job openings may translate directly into unemployment, a nod to upside risks to the labor market. In fact, the median unemployment rate projection for this year went from 4.0% to 4.4% (above the current urate of 4.2%) with the majority of participants now seeing upside risks to these higher forecasts.

In our view, today’s meeting signals an important change in the reaction function – Chair Powell wants to be truly pre-emptive and his tolerance for further softness in the labor market seems quite low. Therefore, even though Powell and the median dot are signaling a series of 25bps cuts in the months ahead, we suspect even a small increase in the unemployment rate could tip the balance to a more aggressive 50bp rate reduction.

To be sure, the 19-member committee is heavily divided, with 8 officials penciling in 75bps of cuts in total this year, and 9 officials looking for 100bps of cuts in total, and two officials seeing 50bps and 1250bps, respectively. However, we believe Powell is one of the 9 officials looking for 100bps of cuts. With today’s fed funds rate of 4.875% still significantly above the FOMC’s neutral estimate of 2.875%, we now expect another 50bps rate cut at the November meeting, followed by a 25bps cut in December. We still see a total of 100bps of cuts in 2025, leaving the policy rates at 3.125%, around our estimate of the neutral rate. There will be two more employment reports and one CPI report before the Nov FOMC meeting, two days after the US presidential election.

The policy path remains binary – if the economy is still headed to a soft landing, then we see the terminal rate of the cutting cycle close to the neutral rate. If the economy is headed to a recession (a significant spike in the unemployment rate), then the terminal rate could move well below the neutral rate.

Fed median dot plot history

Fed dot plot with median, weighted average, and market pricing

FOMC Summary of Economic Projections for 2024, median

Policy statement – strikethrough comparison Sept vs. July

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.

- The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In light of the progress on inflation and the balance of risk, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Lisa D. Cook; Mary C. Daly; Beth M. Hammack; Philip N. Jefferson; Adriana D. Kugler; and Christopher J. Waller. Voting against this